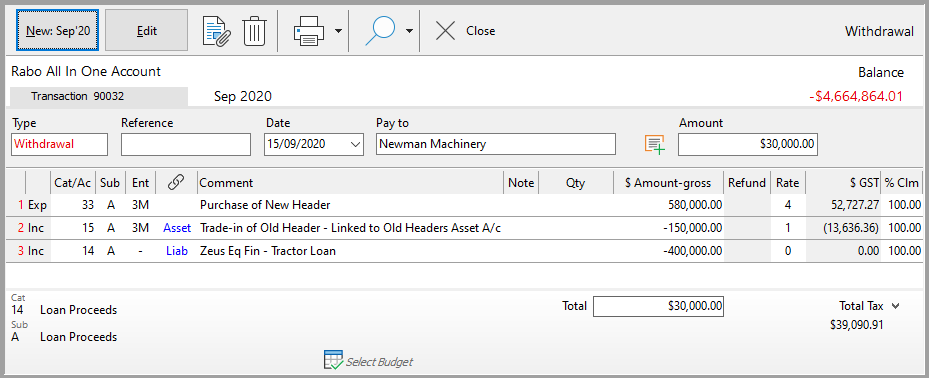

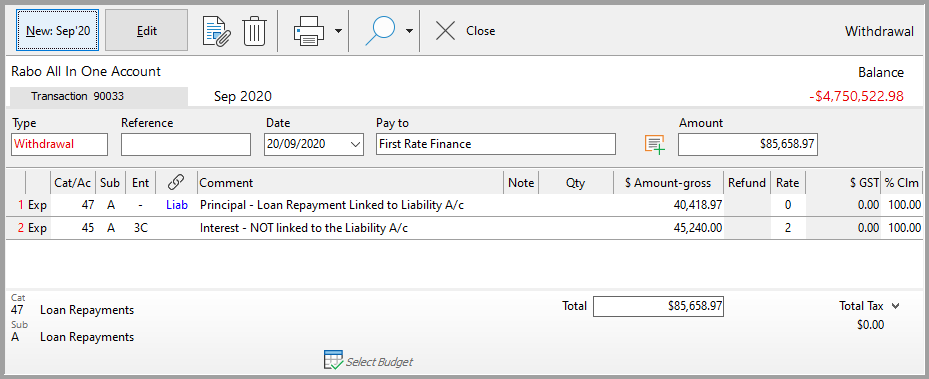

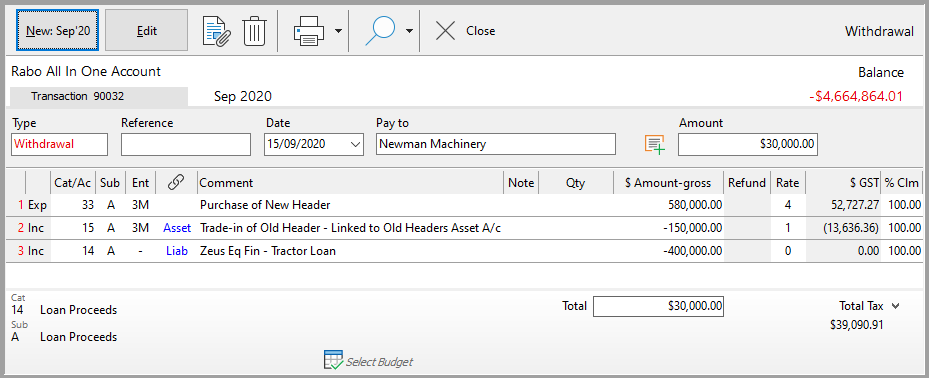

This example shows how enter the asset purchase, the trade-in of the old asset, a deposit into your cashbook while balancing it using balance financed. The asset purchase and trade-in (sale) have both been linked to adjust your asset & liability accounts/sub-accounts and your net worth.

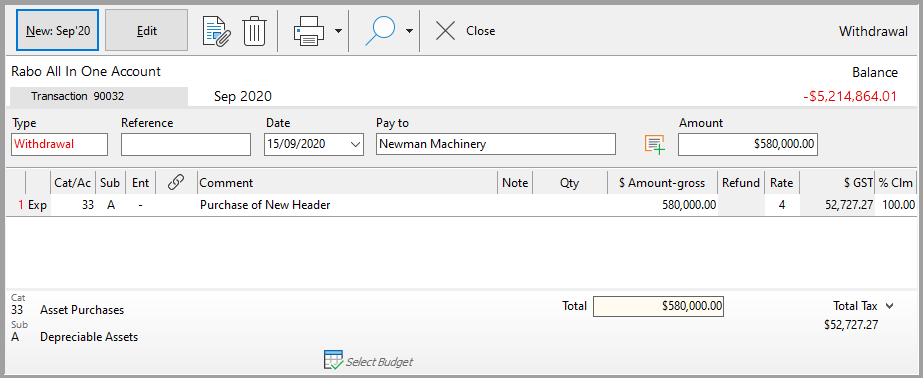

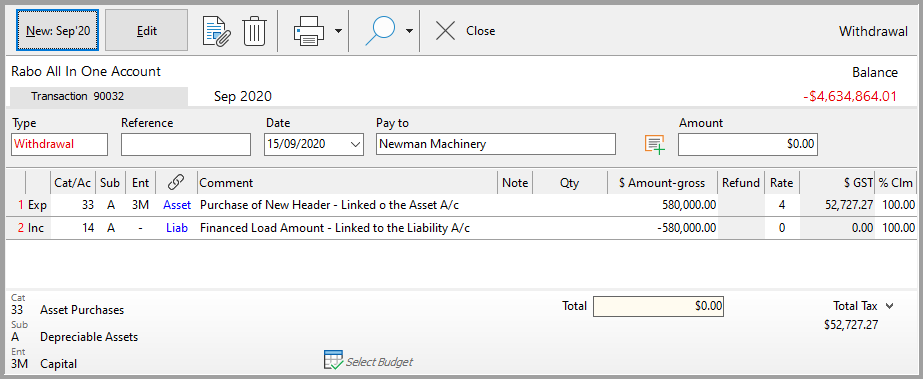

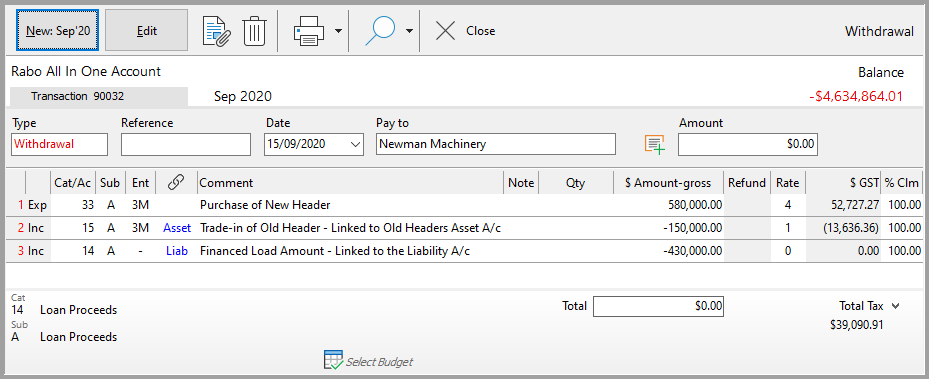

1.Have your Phoenix program open at the enter transaction screen with the account you are making the purchase from selected and the correct period. Make sure the appropriate categories (e.g. Asset Purchases, Asset Sales & Loan Proceeds) setup as well as asset & liability accounts (New Header Asset A/c & New Header Finance Liability A/c) before attempting the entry. 2.Click on the New transaction button and fill in the details for Type, Reference, Date, Pay to & Amount of the transaction. 3.Enter your first dissection line using an asset purchase expense category and link it to the asset account/sub-account you have created. The amount gross will be the purchase price of the asset. Ensure the correct GST rate is set for capital acquisitions. Please consult your accountant for further advice on the GST rate. 4.The second dissection line will use an asset sale income category and will be linked to the appropriate asset account. The amount for this line is the amount received for the trade-in. If you do not have the item, you are trading tracked through an Asset account then do not link this dissection. 5.The third dissection line will be for the finance component. This uses a Loan Proceeds income category to the principal amount of the loan and is linked to the appropriate liability account/sub-account. The purchase price may include amounts which do not include GST. These should be recorded as separate dissections with an appropriate GST rate. Verify the GST on the Tax Invoice from the supplier. If you do not have asset or liability accounts setup please ignore the links.

|