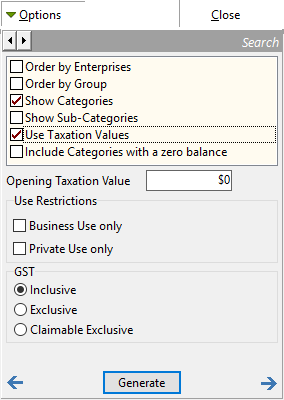

In the Options window in the Profit and Loss report, there is a check box to use taxation values.

Ticking the Use Taxation Values box will cause Phoenix to use the Taxation method or "Cost Price" method for calculating the Livestock Gross Trading Profit. There are a number of issues to be aware of when using this option.

This will only affect the way the Gross Trading Profit is calculated for Livestock accounts. If you are trying to calculate your taxable income, this method will not;

•Change the valuation basis and depreciation calculation of Asset accounts.

•Use Cost Price method for Commodity accounts.

•Separate the livestock into various herds or flocks (see below)

Most Phoenix users choose to record market values for assets and plant. Using market prices will mean that the Net Worth report and Profit and Loss report will yield reliable genuine business position and profitability. However, since these figures are different from the arbitrary figures used for income tax calculation, then these reports will not be reliable for the purposes of estimating income tax liability.

The cost price method is not used for Commodity reporting in Phoenix. Again, this means that Net Worth reports and Profit and Loss reports will yield reliable genuine business position and profitability figures, but not reliable income tax estimation reports.

The Cost Price method when applied to livestock has some unexpected results. In the Profit & Loss report using taxation values, Phoenix treats all livestock accounts together in one report. If you have only one livestock account, or in reporting to the tax office, you treat all livestock as one herd (or flock etc), then this will yield a reliable result. If, however, you report your livestock trading to the tax office in two or more groups (e.g. separating the Stud from the commercial animals, or separating sheep from cattle) then Phoenix’s grouping them together will yield a different result from what you report to the tax office. Unfortunately, because of the arbitrary nature of the cost price method (especially the nominal cost of production for natural increase) reporting several groups together does not give the same profit as the sum of the profits from the individual groups.