|

Navigation: Financial > Day to Day Tasks > GST in Phoenix Balancing the GST Control Account |

Scroll Prev Top Next More |

Why is the GST Control Account not balanced?

Why is the GST Control Account not balanced?

Possible causes - •When the BAS payments are made or refunds received, there are often many parts to the transaction, e.g. GST, PAYG, FTC etc. These components must always be dissected separately in the bank transaction. •The GST component only should be linked to the GST Control account. •Occasionally errors are made when entering data and even if the GST amount is corrected when lodging a BAS, the GST Control account will be out of balance if the data itself is not corrected. •Because GST is only paid in whole dollars, while Phoenix calculates it to the cent, there will always be a small discrepancy between the Control balance, and the payment (or refund). A small rounding discrepancy can be ignored. If, however the discrepancy is greater, say over $100.00 it should be investigated. •The first and most important issue is to identify why the balance is out and correct the situation so that it does not continue. If the imbalance is a result of a single recent mistake, then it can be corrected by unfinalising (if required) the appropriate GST return and carefully editing the error. e.g. the BAS payment or refund wasn’t split into its separate components or the GST amount wasn’t linked to the GST Control account. •If, however, an imbalance is a result of consistent errors over many GST periods, it is preferable to enter a single correcting entry using one of the following examples depending upon which way the balance is out. •If an accountant has advised a manual adjustment to the GST amount on a BAS so it differs to the amount in the GST report in Phoenix, the preferred solution is to find out what the adjustment is for and correct the records in Phoenix, so the GST Calculation sheet agrees with the GST on the lodged BAS. This may not be practical if the adjustment is for multiple entries e.g. at the end of a financial year when the correct business percentage hasn’t been reported for some sub-categories across the whole year or a missed claim in an earlier GST period which doesn’t require an amended return to be lodged. A balancing entry as per the examples below is then the best solution to start off the new financial year with the correct balance.

Importantly, note that a GST Control imbalance in no way effects the accuracy of Phoenix’s calculation of the GST each period. |

The fields below the GST Return

The fields below the GST Return

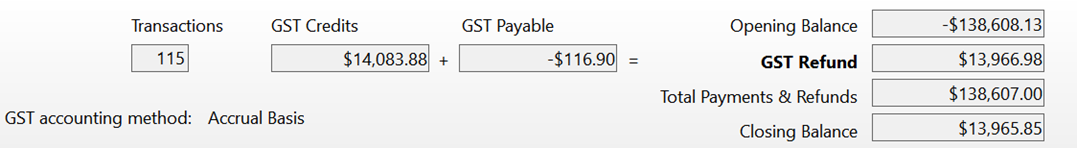

Transactions in all accounts tracked for GST are also recorded in the GST Control account. From these it calculates the GST payable or refundable based on the GST rate applicable to each dissection in a transaction. A GST Control account opened with a balance of $0.00 on July 1, 2000, or when a business first started. All transactions that included GST since then affected the balance of the account. A $330 taxable acquisition moves the balance of the account $30. At the end of a first GST period, the balance of the account will be the same as the GST Payment or GST Refund amount on the GST Calculation sheet in GST Reports. In the next period, the balance of the control account will continue to change according to transactions recorded in that period. The GST Payment or Refund for the previous period should also be linked to the GST Control account when recorded in the bank account to effectively zero the balance from the previous period. Below is an example of the fields seen in the GST Return screen.

The Opening Balance field is the Closing Balance from the previous period. The GST Refund or GST To Pay field shows the amount due, depending on the transactions entered to that point. The Total Payments and Refunds field is only populated once you record a payment or refund from the previous period in a bank account and link it to the GST Control. The Closing Balance field is the Opening Balance plus or minus GST calculated for the current period, plus or minus any GST Payment or Refund recorded in the bank account and linked to the GST Control. The Opening Balance and the Total Payments & Refunds should match (within a few dollars and cents) and the Closing Balance and the GST To Pay or GST Refund should also match to within a few dollars and cents of each other. Be alert for any times when these numbers suddenly have a large difference. Minor differences are usually due to GST being reported in whole dollars on a BAS but calculated to four decimal places in Phoenix. |

Consequences of the GST Control Account Not Being Balanced

Consequences of the GST Control Account Not Being Balanced

•Reports which include the GST Control account balance will be incorrect. •Loading actuals in Budgets and including the GST Control account either to create a new budget or use Load Projected will import the incorrect opening balance which will then have to be manually corrected.

Importantly, note that a GST Control imbalance in no way effects the accuracy of Phoenix’s calculation of the GST each period. |

1.Look only at the GST to Pay or GST Refund amount and the Closing Balance amount, and only after the BAS transaction for the previous period has been entered. GST to Pay should be in parenthesis or have a leading minus, e.g. ($5000.00) or - $5000.00 both in the GST to Pay and Closing Balance fields. GST Refund should have no parenthesis or leading minus e.g. $5000.00.

2.The amount of the imbalance must be calculated, and it determined whether to add this amount to GST Control or subtract it from GST Control.

a.Find the difference between the GST figure and the Control balance. If both figures are in the same sense (both positive or both negative), then subtract the smaller from the larger. e.g. $5000.00 and $2000.00 or -$5000.00 and -$2000.00 = $3000.00. If they are in different senses (one positive and one negative), then add them. e.g. $5000.00 and -$2000.00 or -$5000.00 and $2000 = $7000.00.

b.If the Control account is a greater liability or a lesser asset than the calculated GST, you will need to link a GST Payment. e.g. GST Refund is $2000.00 but Closing Balance is $1000.00 (Closing Balance is lesser asset), or GST to Pay is -$5000.00 and Closing Balance is -$10000.00 (Closing Balance is greater liability).

c.If the Control account is a greater asset or a lesser liability than the calculated GST, you will need to link a GST Refund. e.g. GST Refund is $1000.00 but Closing Balance is $3000.00 (Closing Balance is greater asset) or GST To Pay is -$2000.00 but Closing Balance is -$1000.00 (closing Balance is lesser liability).

3.Go to Enter transactions and record a new $0.00 transaction in the primary bank account. There will be two dissections, each of the amount calculated in step 2a, both allocated to either GST Payment or GST Refund as determined in step 2b or 2c. The first dissection will be linked to the GST control account, the second will NOT be linked, and will have the Refund box ticked. This means there is no impact on reports in the current period for the GST payment or refund category. Clear the zero, journal entry in Reconciliation. Below are examples of common in-balances and how to correct them. |

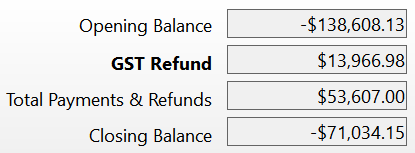

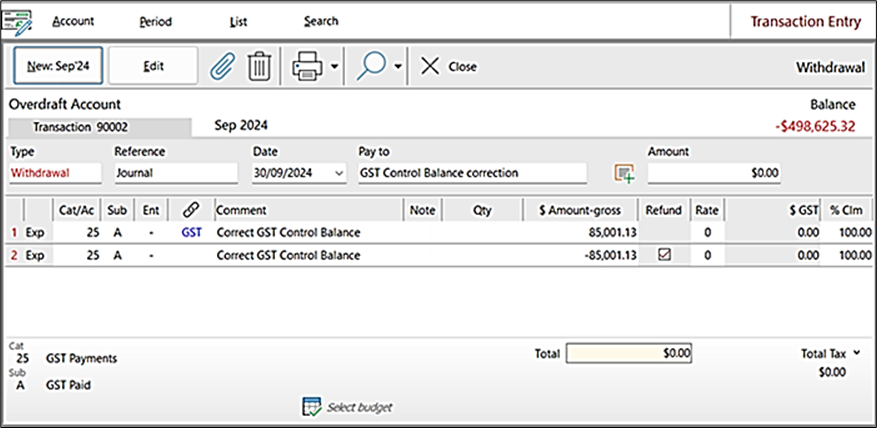

As the Closing Balance in this example is negative and the GST Refund is positive the two amounts must be added together i.e.13966.98 plus 71034.15 equals 85001.13. As the Closing Balance is a liability (amount to be paid) and the GST Refund is an asset, the correcting entry in the main bank account would be recorded as a GST Payment as follows:

The GST Payments category has been used with Payment as the Type in the link. Because only one dissection has been linked to the GST Control, the Total Payments & Refunds amount will increase, thus correcting the Closing Balance to be the same as the GST Refund amount. |

Example 2 - GST Refund amount is less than the Closing Balance, but they are both positive amounts.

Example 2 - GST Refund amount is less than the Closing Balance, but they are both positive amounts.

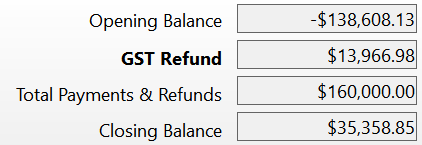

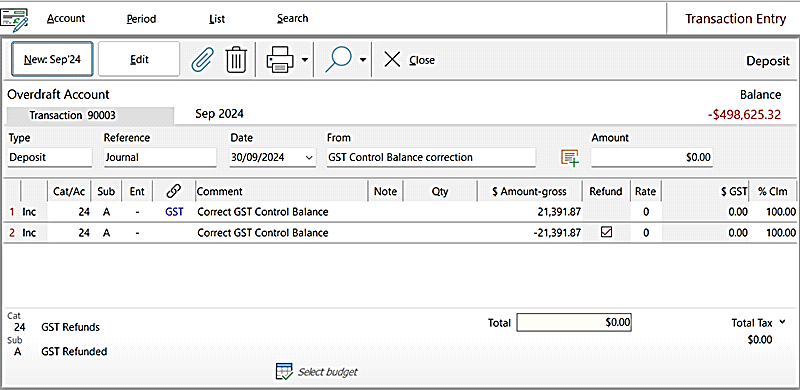

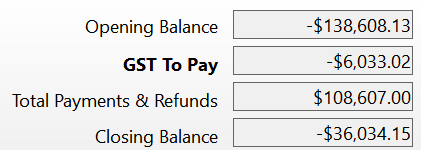

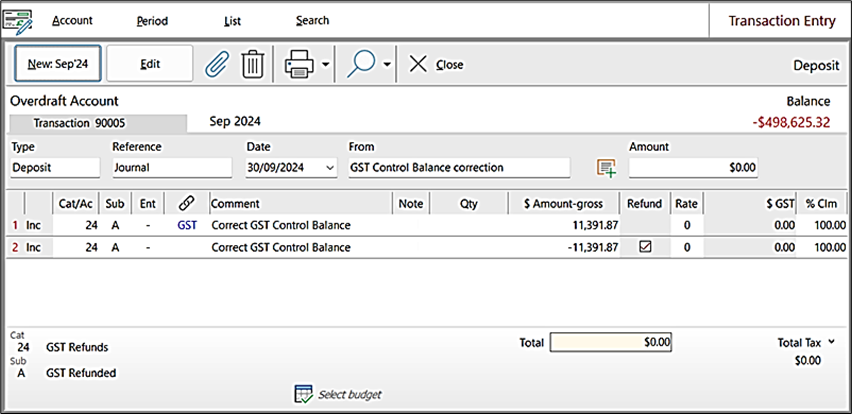

As the GST Refund and Closing Balance are both the same sense (both positive), the smaller amount must be subtracted from the larger i.e. 35358.85 minus 13966.98 equals 21391.87. As the Closing balance is a greater asset than the GST Refund, the correcting entry would be recorded in the primary bank account as a GST Refund as follows:

The GST Refunds category has been used with Refund Received as the Type in the link. Because only one dissection has been linked to the GST Control, the Total Payments & Refunds amount will decrease in this example, thus correcting the Closing Balance to be the same as the GST Refund amount. |

Example 3 - GST To Pay is less than the Closing Balance and they are both negative amounts.

Example 3 - GST To Pay is less than the Closing Balance and they are both negative amounts.

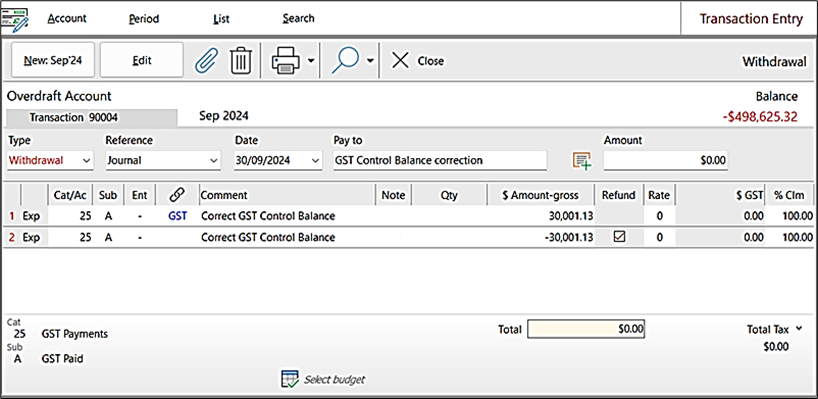

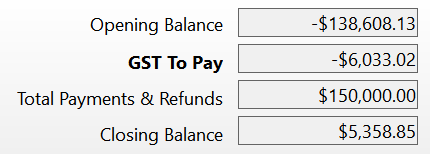

As GST To Pay and Closing Balance are both the same sense (both negative), the smaller amount must be subtracted from the larger amount i.e. 36034.15 minus 6033.02 equals 30001.13. As the Closing Balance is a greater liability amount than the GST To Pay the correcting entry would be recorded in the primary bank account as a GST Payment as follows:

The GST Payments category has been used with Payment as the Type in the link. Because only one dissection has been linked to the GST Control, the Total Payments & Refunds amount will increase in this example, thus correcting the Closing Balance to be the same as the GST To Pay amount. |

Example 4 - GST To Pay is a negative amount and the Closing Balance is a positive amount.

Example 4 - GST To Pay is a negative amount and the Closing Balance is a positive amount.

As GST To Pay is positive and Closing Balance is negative the two need to be added together. i.e. 6033.02 plus 5358.85 equals 11391.87. As the Closing balance is a greater asset than the GST To Pay liability amount the correcting entry would be recorded in the primary bank account as a GST Refund as follows:

The GST Refunds category has been used with Refund Received as the Type in the link. Because only one dissection has been linked to the GST Control, the Total Payments & Refunds amount will decrease in this example, thus correcting the Closing Balance to be the same as the GST To Pay amount. |

If you experience any issues trying to balance your GST Control account which have not been covered in this Help Note, please contact AGDATA Support.

©2025 AGDATA Holdings Pty Ltd trading as AGDATA Australia