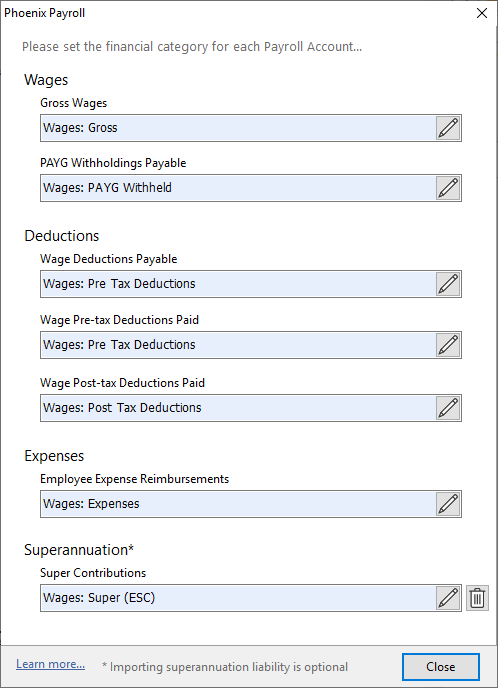

If you haven’t already created an expense category to record the wages, now is the time to create it following the example below. If you have created a category with many sub categories for individual employees to handle your wages, you will need to restructure as this integration cannot import details for individual employees. Phoenix Payroll maintains the records for as many employees as you would ever have, so there is no need to replicate that in your financial program. Your categories will need to reflect the example below.

If you have set up liability accounts for PAYG withheld and/or Super Guarantee Levy, they should be linked to your sub-categories as shown below. The recording of liability accounts is optional. If no links are defined in Category Setup, the integration of transactions to the cashbook will proceed without them.

Expense Category

|

Sub-category

|

GST Rate

|

Link to Liability a/c and sub a/c (optional)

|

Wages

|

A Gross Wages

|

0

|

|

|

B PAYG Withheld

|

0

|

Tax Withheld

|

|

C Pre-Tax Deductions

|

0

|

|

|

D Post Tax Deductions

|

0

|

|

|

E Expense Reimbursement

|

0

|

|

|

F Super Contributions

|

0

|

Employee Super

|

It is also possible to create just one Deductions sub-category and then map multiple Deduction Payroll Journal Accounts to the one Deductions Financial sub-category.

An alternative to the above would be to have more than one expense category with the sub categories appropriately grouped maybe as below.

Expense Category

|

Sub-category

|

GST Rate

|

Link to Liability a/c and sub a/c (optional)

|

Gross Wages

|

A Gross Wages

|

0

|

|

PAYG

|

A PAYG Withheld

|

0

|

Tax Withheld

|

|

B PAYG Paid

|

0

|

Tax Withheld

|

Employee Deductions

|

A Employee Deductions

|

0

|

|

|

B Expense Reimbursement

|

0

|

|

Employer Super

|

A Super Contributions

|

0

|

Employee Super

|

Phoenix Payroll records and stores all information relating to individual employees. There is no need to record this in Phoenix. Individual sub-categories or sub-accounts for employees is no longer required. The integration will not allow entries to be allocated to individual employee sub-accounts and sub-categories.

If you have worked with wages categories before, it is our recommendation that you create this new category structure from here on in and leave your old structure as is so you can report on any past individual employee wages transactions. This also applies to any liability accounts that have previously been used to track Tax Withheld and Super – we recommend creating new accounts when you commence using Phoenix payroll. Once your categories (and liability accounts, if applicable) have been sorted, continue the following steps to integrate.

Note that the linking shown above is optional. Gross Wages and Tax Withheld will be imported if the category mapping below is setup. The linking is only required if you plan to maintain your employee liability accounts. If you are linking to the liability accounts, you must link to the account and sub-account. If you link to the account only, then the import will not be able to complete the link.

Note: Even though it is optional, the linking is the only way that Phoenix can import any information about the Super Guarantee Levy liability.

|