This Article is to aid users in the recording of asset purchases where the GST is claimed up front, as well as recording the finance repayments for the asset purchase. If you are unsure of your eligibility to claim GST up front, please contact your accountant.

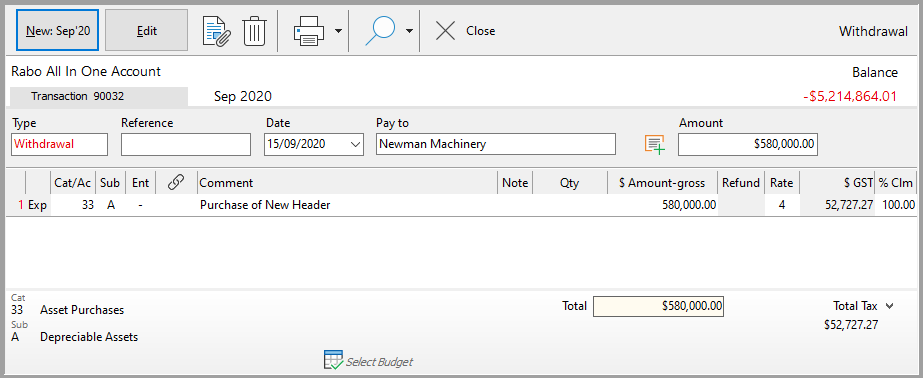

This example shows how to enter an asset purchase into your cashbook where the full amount is paid from the bank account. 1.Have your Phoenix program open at the enter transaction screen with the account you are making the purchase from selected and the correct period. Make sure to have the appropriate categories setup before attempting the entry e.g. Asset Purchases 2.Click on the New transaction button and fill in the details for Type, Reference, Date, Pay to & Amount of the transaction. 3.Enter the dissection line using an expense category for asset purchase an ensure the correct GST rate is set for capital acquisitions. Please consult your accountant for further advice on the GST rate. If you are using Asset accounts, you could link the transaction to the appropriate Asset account. |

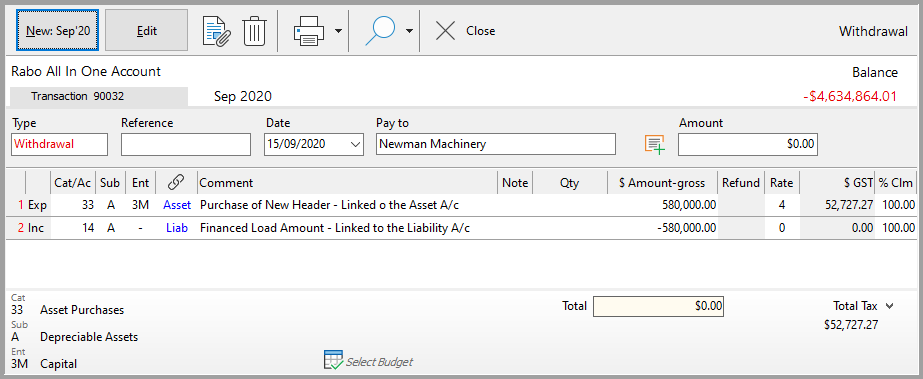

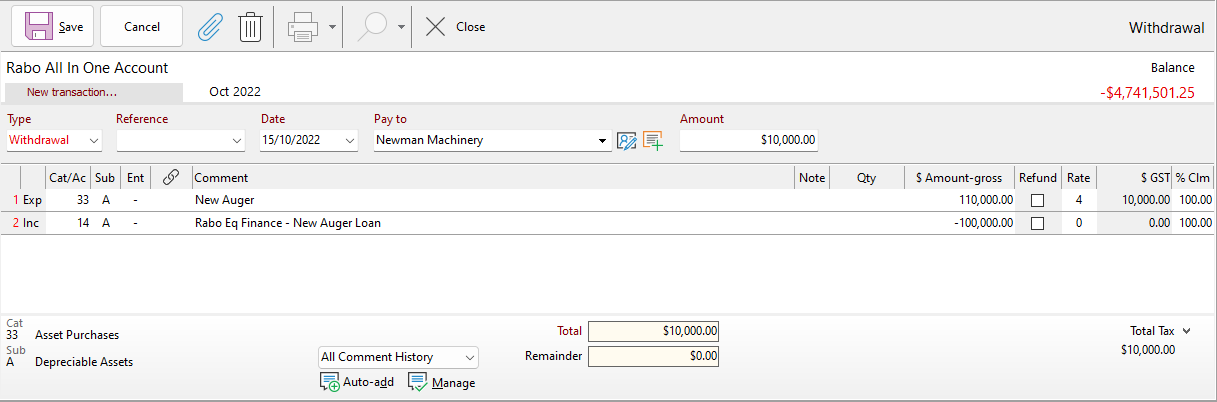

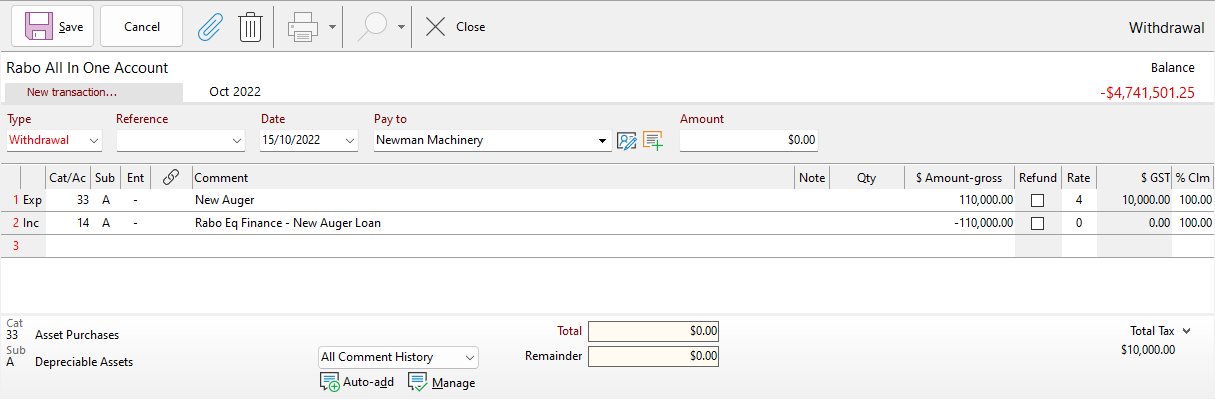

This example shows how to enter an asset purchase into your cashbook when the finance company has paid the supplier directly for the full cost of the asset and linking to asset & liability accounts to adjust your net worth. 1.Have your Phoenix program open at the enter transaction screen with the account you are making the purchase from selected and the correct period. Make sure the appropriate categories as well as asset & liability accounts are setup before attempting the entry e.g. Categories: Asset Purchase & Loan Proceeds & Asset & Liability accounts: New header asset & New finance for the header liability.

2.Click on the New transaction button and fill in the details for Type, Reference, Date, Pay to & Amount of the transaction.

3.Your first dissection line will use an asset purchase expense category as in the first example but this time you will link it to the new asset account/sub-account. The amount gross will be the purchase price of the asset. Ensure the correct GST rate is set for capital acquisitions. Please consult your accountant for further advice on the GST rate.

4.The second dissection line will be for the finance component. This example uses a Loan Proceeds income category to enter the principal amount of the loan and is linked to the appropriate liability account/sub-account. The purchase price may include amounts which do not include GST. These should be recorded as separate dissections with an appropriate GST rate. Verify the GST on the Tax Invoice from the supplier. If you do not have asset or liability accounts setup please ignore the links.

|

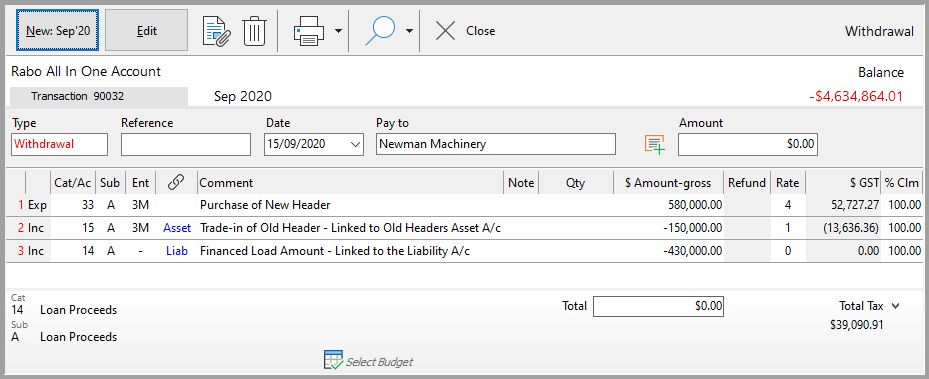

This example shows how to enter the asset purchase, the trade-in of the old asset and the balance financed into your cashbook. The asset purchase and trade-in (sale) have both been linked to the asset & liability accounts and your net worth. 1.Have your Phoenix program open at the enter transaction screen with the account you are making the purchase from selected and the correct period. Make sure the appropriate categories (e.g. Asset Purchases, Asset Sales & Loan Proceeds) setup as well as asset & liability accounts (New Header Asset A/c & New Header Finance Liability A/c) before attempting the entry. 2.Click on the New transaction button and fill in the details for Type, Reference, Date, Pay to & Amount of the transaction. 3.Enter your first dissection line using an asset purchase expense category and link it to the asset account/sub-account you have created. The amount gross will be the purchase price of the asset. Ensure the correct GST rate is set for capital acquisitions. Please consult your accountant for further advice on the GST rate. 4.The second dissection line will use an asset sale income category and will be linked to the appropriate asset account/sub-account. The amount for this line is the amount received for the trade-in. If you do not have the vehicle you are trading tracked through an Asset account, then do not link this section. 5.The third dissection line will be for the finance component. This example uses a Loan Proceeds income category to enter the principal amount of the loan and is linked to the appropriate liability account/sub-account. The purchase price may include amounts which do not include GST. These should be recorded as separate dissections with an appropriate GST rate. Verify the GST on the Tax Invoice from the supplier. |

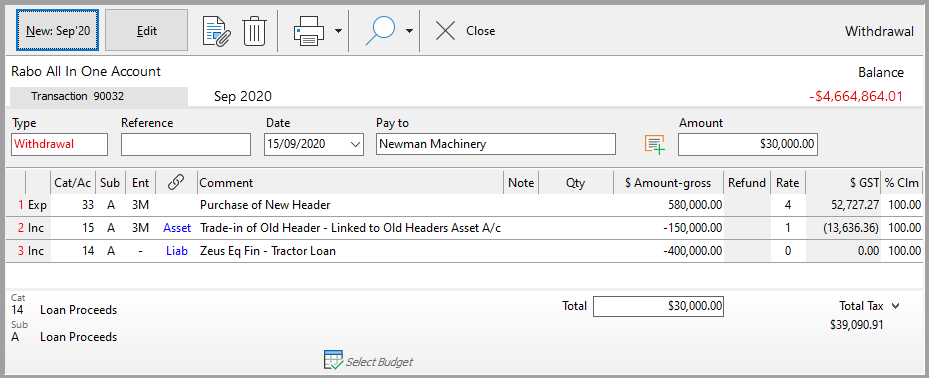

This example shows how enter the asset purchase, the trade-in of the old asset, a deposit into your cashbook while balancing it using balance financed. The asset purchase and trade-in (sale) have both been linked to adjust your asset & liability accounts/sub-accounts and your net worth. 1.Have your Phoenix program open at the enter transaction screen with the account you are making the purchase from selected and the correct period. Make sure the appropriate categories (e.g. Asset Purchases, Asset Sales & Loan Proceeds) setup as well as asset & liability accounts (New Header Asset A/c & New Header Finance Liability A/c) before attempting the entry. 2.Click on the New transaction button and fill in the details for Type, Reference, Date, Pay to & Amount of the transaction. 3.Enter your first dissection line using an asset purchase expense category and link it to the asset account/sub-account you have created. The amount gross will be the purchase price of the asset. Ensure the correct GST rate is set for capital acquisitions. Please consult your accountant for further advice on the GST rate. 4.The second dissection line will use an asset sale income category and will be linked to the appropriate asset account. The amount for this line is the amount received for the trade-in. If you do not have the item, you are trading tracked through an Asset account then do not link this dissection. 5.The third dissection line will be for the finance component. This uses a Loan Proceeds income category to the principal amount of the loan and is linked to the appropriate liability account/sub-account. The purchase price may include amounts which do not include GST. These should be recorded as separate dissections with an appropriate GST rate. Verify the GST on the Tax Invoice from the supplier. If you do not have asset or liability accounts setup please ignore the links. |

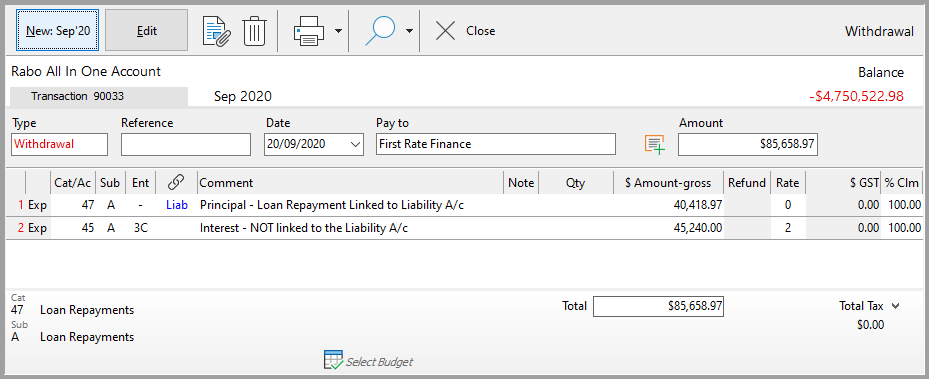

This example shows how to enter the loan repayment in your cashbook. The payment is dissected into the principal and interest amounts. The principal has been linked to the liability account to reduce the balance owing. 1.Have your Phoenix program open at the enter transaction screen with the account you are making the payment from selected and the correct period. Make sure to have the appropriate categories as well as asset & liability accounts/sub-accounts setup before attempting the entry e.g. Loan Repayments & Interest. 2.Click on the New transaction button and fill in the details for Type, Reference, Date, Pay to & Amount of the transaction. 3.Enter your first dissection line for the Principal amount of the repayment. Use a Loan Repayments expense category linked to the Liability account/sub-account you have created. Ensure the GST rate is set to 2 for no GST in price. Please consult your accountant for further advice on the GST rate. 4.The second dissection line is for the Interest amount of the repayment. Use an Interest expense category which is NOT linked to any asset or liability account. The interest is not linked to the asset or liability account as it is not included in the finance amount. The finance amount is only the principal of your repayment and should be linked to decrease the liability finance amount. |

Often a finance company will state that the GST portion of an asset purchase must be paid by the purchaser as they won’t provide finance for GST. |

No payment is made at the time of purchase, but the GST portion is paid to the finance company later (usually within a month of the purchase). The purchase is recorded as below with links to the asset and liability accounts (if used). In this situation, the $10,000.00 is paid to the finance company and is all principal so allocated to Loan Repayments and if a liability account is used it will be linked to that. Subsequent loan repayments will have both principal and interest. |

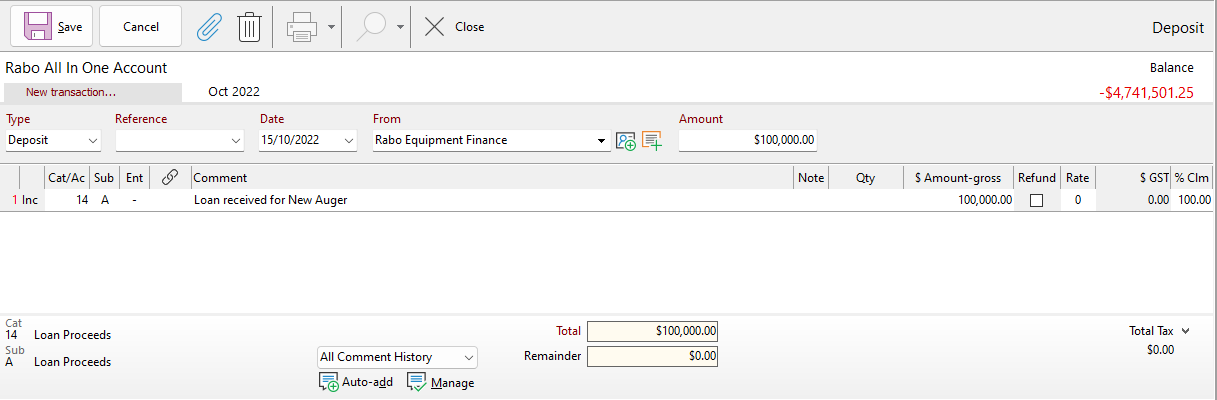

An Asset is paid for by the purchaser in full and then once the finance is approved, the loan amount is deposited into the purchaser’s bank account.The purchase entry is recorded in the same way as the first example 'Entering a basic asset purchase transaction'. The loan deposit is recorded like any other deposit in the bank account and allocated to the Loan Proceeds category. If a liability account has been set up for the loan it would be linked to the loan or if preferred Account Transfer to the loan account can be used.

|

*Please Note that the GST rates specified in this document are in no way to be treated as financial advice. AGDATA recommends you consult with your accountant regarding which GST rates to use

Comments contained in this article are developed from the experience of the team at AGDATA Australia. We are not qualified tax agents or financial advisors and therefore any information or comments offered are in no way intended to represent professional taxation or financial opinion. Clarification on such issues must always be obtained from an appropriate source such as the Business Activity Statement Instruction Booklet, the Australian Taxation Office or your accountant.

©2025 AGDATA Holdings Pty Ltd trading as AGDATA Australia