For Open Item customers and suppliers a GST rate is recorded against any Opening Balance entries which have been created through opening a new Customer or Supplier sub-account with an existing balance. The appropriate GST rate on these transactions depends on whether GST is tracked on a cash or accrual basis.

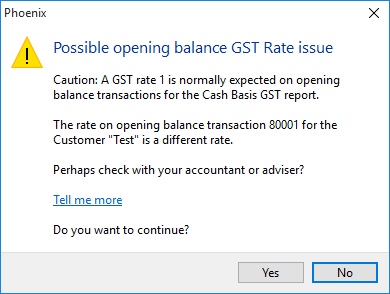

If in running a GST report Phoenix detects that the GST rate on an opening balance transaction is not what it expects it to be for the GST tracking method in use for the report period, it generates a warning.

A report on all Opening Balance Expense and Opening Balance Income transactions for the period can be generated and the GST rates checked to ensure that the GST is picked up correctly when a payment is applied. Go to Reports/Category Review and filter the Categories just for those Opening Balance Income and Expense categories.

If GST is being tracked on accrual basis the GST rate on the opening balance entries would be expected to be zero as GST should have been accounted for prior to being entered as an opening balance in this set of books. Any payments applied to an opening balance with a zero GST rate will not record a GST amount in the GST Return.

If GST is tracked on Cash basis the expected GST rate for an Opening Balance transaction is Rate 1 but it could be any of the available rates, depending on what the income or expenses included in the opening balance were. When a payment is applied to the opening balance the GST amount will be recorded in the GST Return against the opening balance transaction. There may be circumstances where an opening balance may have both GST and non GST amounts. In that situation an adjustment needs to be made in the customer or supplier sub-account so the correct GST amount is recorded when a payment is applied.