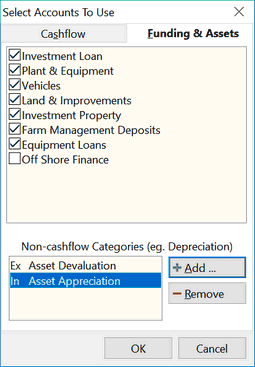

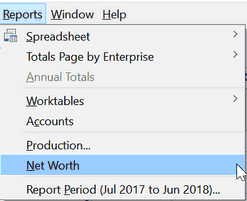

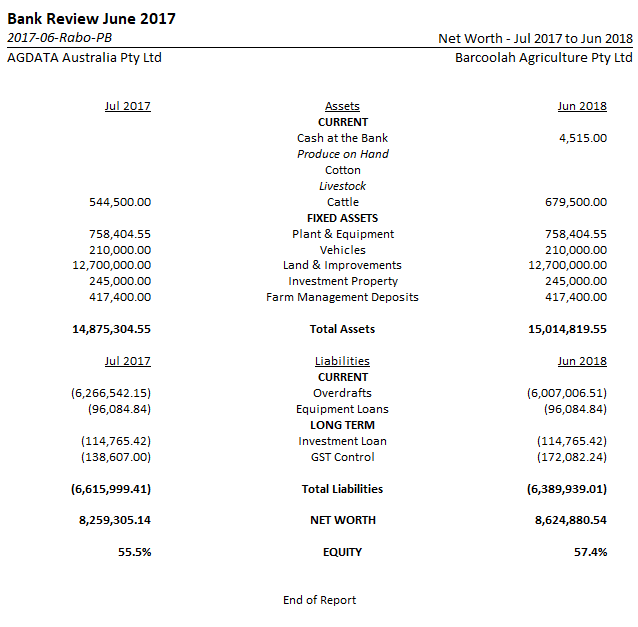

Just as a Net Worth report can be generated in the Financial and Financial Pro modules, so too can it be generated for a budget in both Budget Planner and Power Budgets. For the Net Worth report to truly represent the financial position of the entity the asset and liability accounts found under the Use button on the Budget tool bar and the Funding & Asset tab need to be included in the budget.

If Asset Depreciation and Asset Appreciation categories are used to revalue assets they should be set as Non-cashflow categories in Use/Funding & Assets.

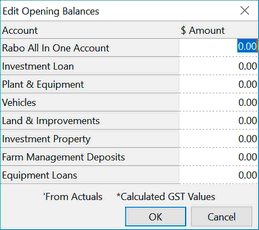

Opening balances for the Funding and Asset accounts are recorded within the  button on the tool bar.

button on the tool bar.

The Asset Appreciation and Asset Devaluation categories can use worktables to adjust the values of the assets where required in the budget, without impacting the cashflow. Other changes to asset values such as adding to FMDs are updated through links from worktables in the cashflow section of the budget.

Liability account values should be updated by using links in worktables in the appropriate expense categories.

NB: If Load Projected is used Funding & Asset accounts won’t be updated from Actuals and the opening values for those will need to be re-entered. Adjustments to Funding & Asset accounts made through worktables in the budget will be retained in the budget period. Load Actuals will not include Funding and Asset Accounts. They must be added after a Load Actuals and balances manually recorded.