When invoices are entered in Open Item Customer and Supplier accounts, Phoenix looks at the GST tracking method to determine how the transaction will be recorded in the GST Control account.

In the case of Cash GST reporting, the invoice is recorded in the GST Control account with the invoice amount showing in the GST Return window under the $ Total column and the GST amount in the $ GST column, but they will be grey and in italics with the GST amount not included in the $ Balance column. The amount of the GST is determined by the GST rates and percentages on the categories used in the dissections on the invoice.

When an invoice is paid and the payment linked to the invoice, the invoice amounts previously recorded will no longer be grey and in italics and the GST amount will be included in the calculation of the $ Balance amount.

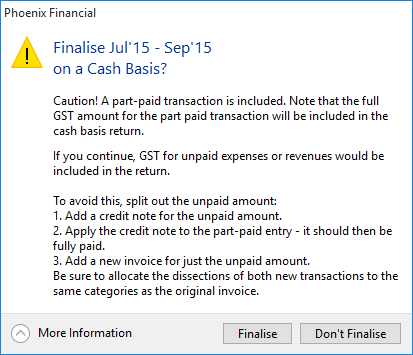

If an invoice is only part paid the program has no way of determining which dissections to use to calculate the amount of GST for only the paid amount. It therefore still includes the full GST amount in the $ Balance calculation as though the whole invoice was paid. As only the GST on paid invoices can be claimed when reporting GST on a Cash basis, an adjustment therefore needs to be made in Phoenix for those unpaid amounts.

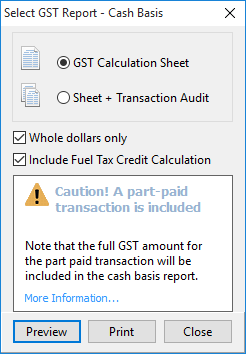

If there are part paid invoices a the warning message below will appear when clicking on Report in the GST Return window.

Clicking on More Information….. will provide instructions on how to correctly deal with these part payments.

See also: