The ability to separate Business and Private expenses only applies if GST Tracking has been enabled.

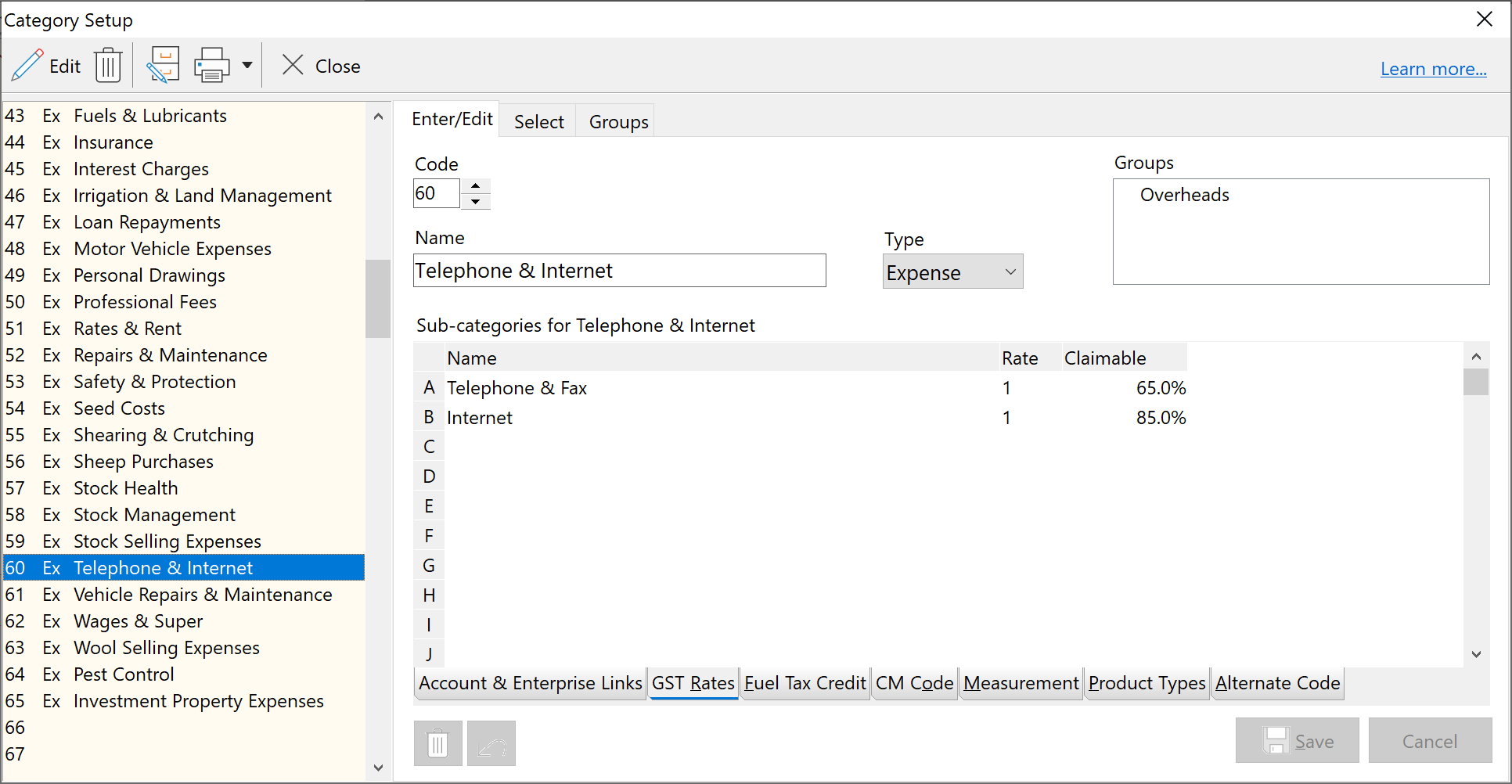

Every dissection entry that is added in Phoenix has a Claimable % recorded against it. The Claimable % is tied to a category but can also be overridden when a transaction is entered or edited. The Claimable % for a category can be set from the Category Setup screen on the GST Rates tab.

See also GST Rates in Category Setup

The Claimable % is deemed to be the Business use. If it is not set to 100% then the remainder is deemed to be Private / Personal use.

Currently, the Business Use and Private use can be separated in the following reports:

Trial Balance

•Show Private Use will separate the private component but still report the business component separately.

Income & Expenditure / Profit & Loss

•Show Business use will show only the business component.

•Show Private use will show only the private component.

See also: