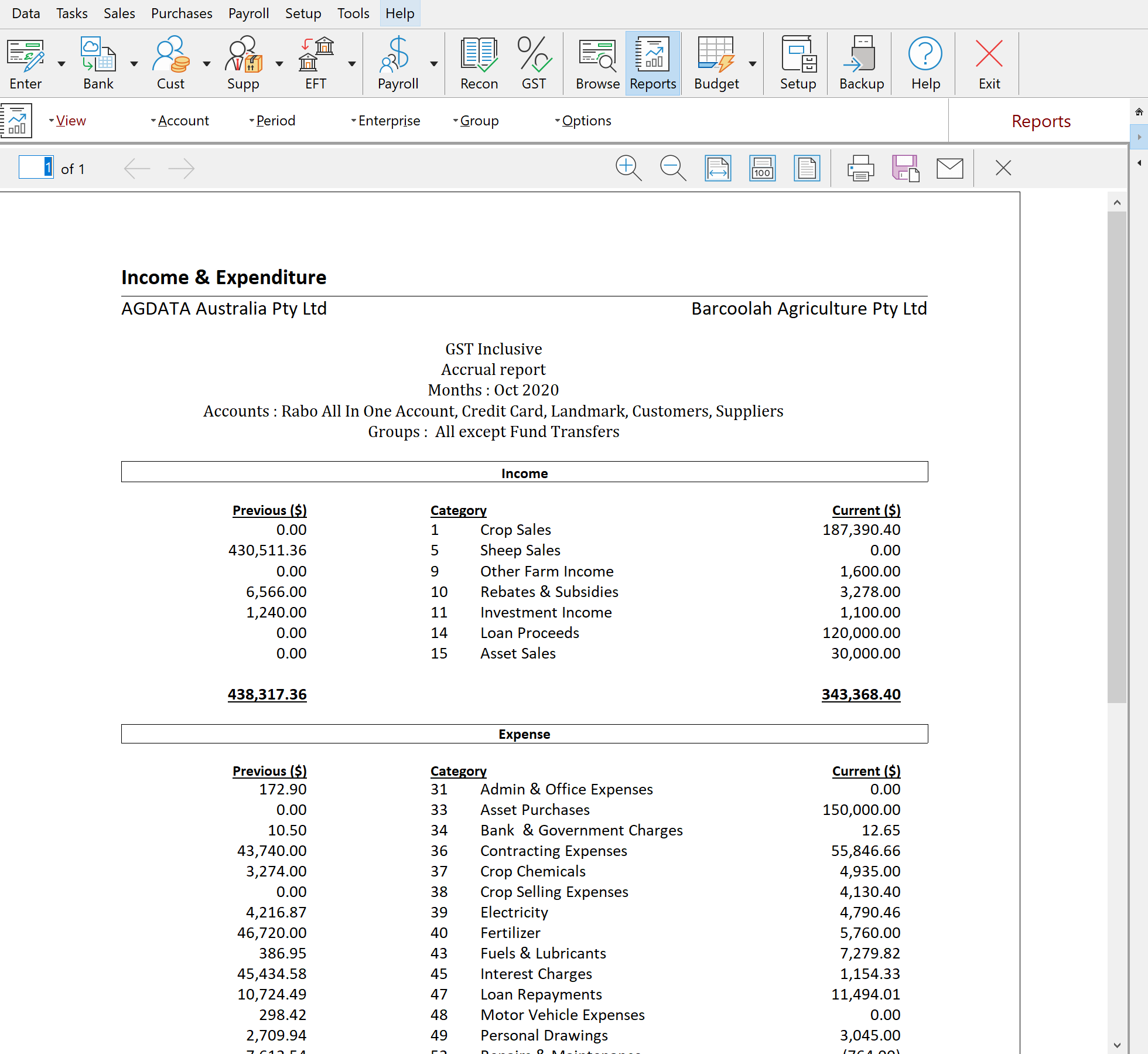

An Income & Expenditure report shows all income and expenditure broken up by category. The report shows total income and total expenditure and calculates the excess income or expenditure.

When only reconciled accounts are selected, the report shows the change in the cash flow situation. If Reconciled and Asset accounts are displayed then any transfers between accounts do not appear on the I/E report by default. An example of such a transaction is as follows. If a tractor was purchased for $200,000 cash and the asset recorded in the Plant and Equipment asset account as a transfer or a linked entry (see Linking & Transferring ), then the transaction is treated as a transfer from the reconciled account to the asset account. If both the Reconciled and the Asset accounts are included in an I/E report, the transaction value is not seen in the I/E report. This is because the debit in the reconciled account is offset by the credit in the asset account.

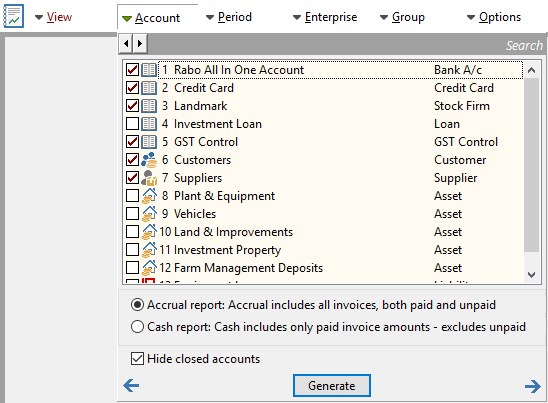

In general an I/E report should normally only include the reconciled accounts and any asset accounts that deal primarily with cash.

Another important option available with the I/E report is the ability to compare your current year with previous years. This is done by selecting Options from the Selection Bar and in the Avg. of last box, enter the number of previous years you wish to compare. If only one year is selected then the report defaults to compare this year with last year. If more than one year is selected then it averages the past number of years and present an average figure in the previous column.

To view all the category amounts, scroll through the report using the up and down arrow keys or the mouse.

To view more detail of a particular amount on the report, move the mouse over the transaction until the mouse pointer changes to a magnifying glass. While the pointer is still a magnifying class click on the transaction. This produces another report showing what transactions make up the amount on the report.

See also: