A projected cash flow budget allows you to combine your actual cash flow with a budget.

1.Select the Load Projected option from the File menu. This will only be available if Cash Book transactions have been entered in the current set of data.

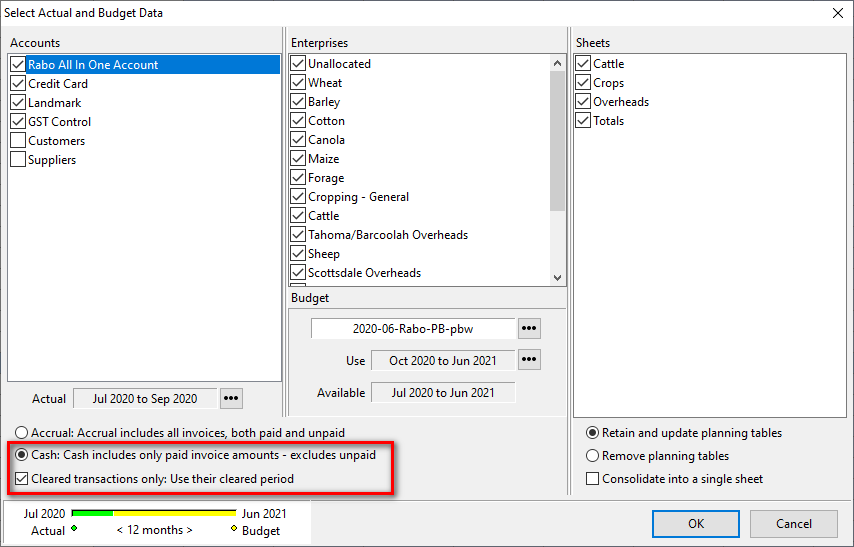

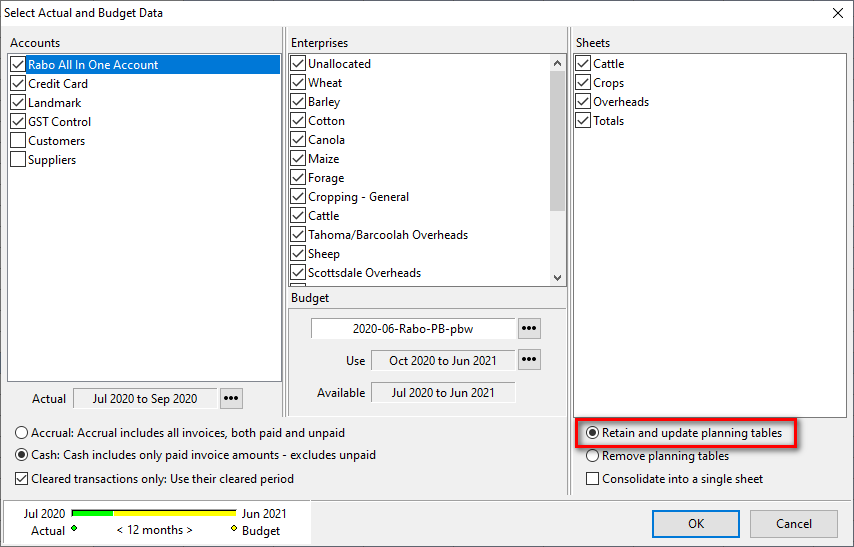

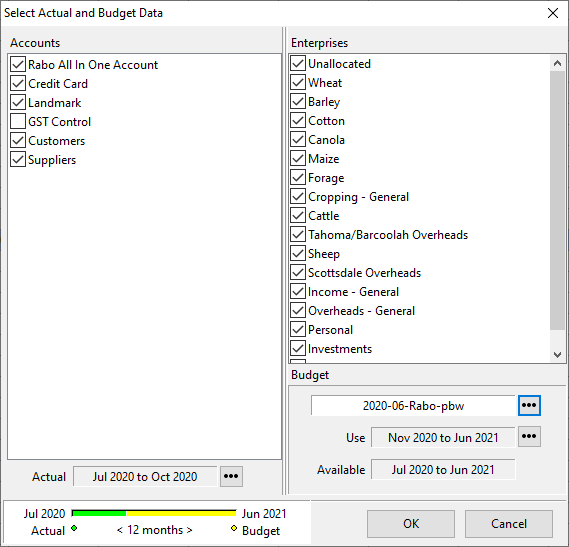

2.Select the accounts, period and enterprises for the actual data as required. The Period Selection is displayed in the bottom left field with the Actual period showing in green and the Budget period in yellow.

3.You may shorten the period of actual records if required by clicking the button to the right of this field and adjusting the period line. Select OK to confirm the period shown or adjust it as necessary.

Hint: The last month highlighted is usually the current month. If you have not yet entered any transactions in the current month, then you should not include it in the projected budget. It would only show $0.00 amounts. In this case, shorten the period of Actuals to the previous month so that you still show the budget for the current month.

4.Select the budget with which you wish to merge your Actuals by clicking the button to the right of the "Use" budget period.

5.Phoenix then merges the budget with the Actuals on screen in to a new budget. The spreadsheet is given the title "Projected Budget", and each month is labelled either "Actual", or "Budget" so that you know where the data for the month was derived.

You may modify the amounts in the projected budget for “what if” analysis. However, if you alter any amount in an Actuals month then the spreadsheet title reverts to “Untitled” since the spreadsheet no longer shows the true projected budget.

You may save a projected budget. When you later recall it, the Budget program remembers that it was a projected budget and displays the appropriate labels to show what data is actual and what is budget.

NOTE: Loading GST Inclusive or Exclusive

In Budget Planner,loading the actual figures as GST Inclusive or GST exclusive is determined by whether the GST Control Account is selected in the list of accounts. If the GST Control account is included, the actual amounts in the Cashflow will be GST Exclusive. If the GST Control account is not included the actual amounts will be loaded GST Inclusive. Ensure that the actuals are loaded GST Inclusive or Exclusive to match how the budget figures were entered in the Projected budget file.

In Power Budgets, because GST Inclusive or Exclusive is selected when creating the budget, Phoenix will load the actuals when doing a Load Projected based on this selection.

See Also Loading Actuals

See Also: GST in Power Budgets