If Phoenix has Actual transactions entered in the current set of books, you can load the budget with these values to be used in

•Reports

•Graphs

•New budgets (as a starting point)

•Projected budgets

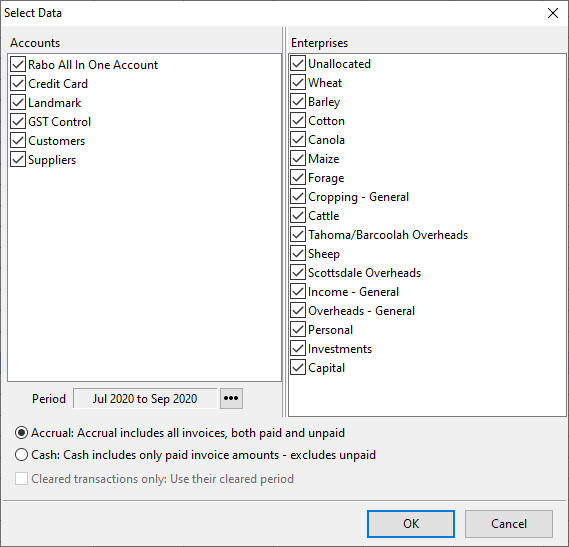

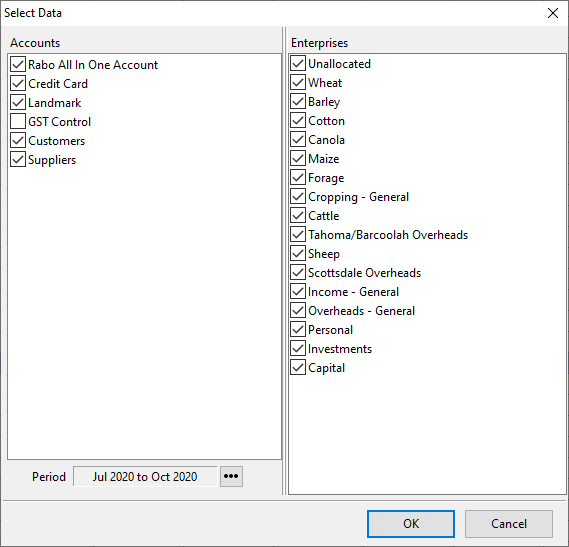

Select the Load Actuals option from the File menu to display the following window.

To choose the account and enterprise data to be included, click the specific accounts and enterprises with the mouse so as to place or remove a tick in the desired choices.

Note: The screen shot above is from Budget Planner so doesn’t have the Cash or Accrual or Cleared transactions only options.

In Budget Planner only loading the actual figures as GST inclusive or GST exclusive is determined by whether the GST Control account is selected or not. The GST Control account is not selected in this example which means the actual data will be loaded as GST inclusive. If the GST Control account is ticked the actual data will be loaded as GST exclusive in the Cashflow with the GST component of the transactions shown against the GST Control account at the bottom of the budget.

In Power Budgets when Load Actuals is selected you will be prompted to select GST Inclusive or GST Exclusive before the Select Data window is displayed.

You can vary the period of actuals being loaded by clicking the  button and using the selector provided to set the period.

button and using the selector provided to set the period.

When the actual records have been loaded, you may carry out “what if” analysis of your profit performance without affecting your financial data.

Naturally you can't save these figures back to the actual transactions. You may, however, save them as a separate file for later recall.

If you modify any amount in the spreadsheet, then the spreadsheet title reverts to "Untitled" since the spreadsheet no longer shows true actual figures.

See Also: To Load a Projected Cash Flow

See Also: GST in Power Budgets