Unpresented transactions should be written off after an appropriate amount of time. You cannot simply delete a transaction when it becomes apparent that the transaction will never be presented at the bank. The transaction has been included in GST returns, and probably even in an annual tax return. The correct way to "write off" the transaction is to enter a completely new transaction as the exact reverse of the original, then mark both transactions as cleared in the reconciliation. This will undo the effect of that transaction in any previous reports or returns, yet will not have any effect on account balances.

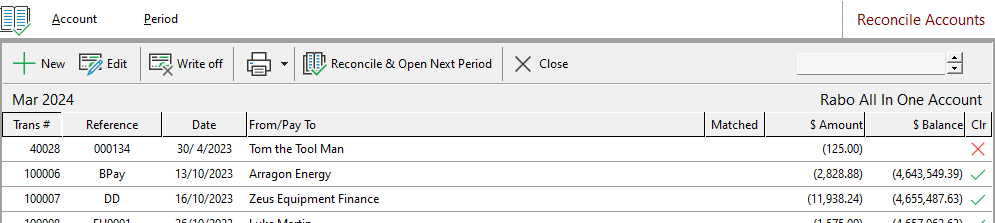

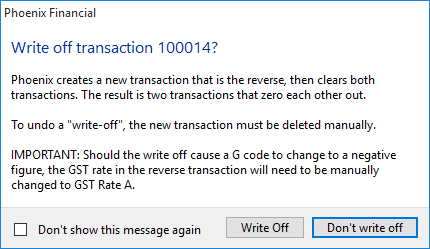

In the Reconciliation screen, there is a Write Off button. Select the transaction that will never clear, then click the Write Off button. Phoenix will display a confirmation box describing what is about to happen. Click Yes and the job is done.

A transaction displayed in the list in blue print is a write off transaction. There will be a note attached to the new write off transaction as well as the original transaction. The default date of the write off transaction is the date on the day you do the Write off. If you are reconciling September but it is actually October for example you may need to edit the date of the transaction to a date in September. Similarly the note attached to both the original and write off transactions will have the date on which the transaction occurred and may also need to be edited.

See also Customising Phoenix - Advanced