Recording Journal entries in Phoenix

Journal entries may be required for a variety of reasons. Commonly in Phoenix Financial they are used to record personal drawings used for a business expense, business income deposited to a private account and used for personal drawings, correcting past entries entered incorrectly or recording purchases of assets when there was no initial monetary payment involved.

A journal entry can be recorded in an existing bank account or a specific reconciled bank account set up just for cash and journal entries, if the number of these type of entries warrants it. A journal entry in Phoenix will usually be an entry which is not a usual income or expense transaction appearing in a bank account and will include allocations to both income and expense categories resulting in a net zero transaction in the bank account.

These zero entries should be cleared in the bank reconciliation even though they don’t change the account balance.

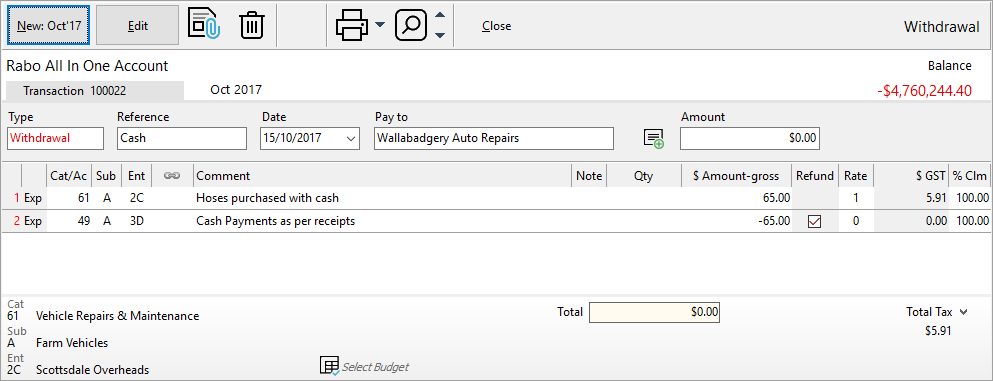

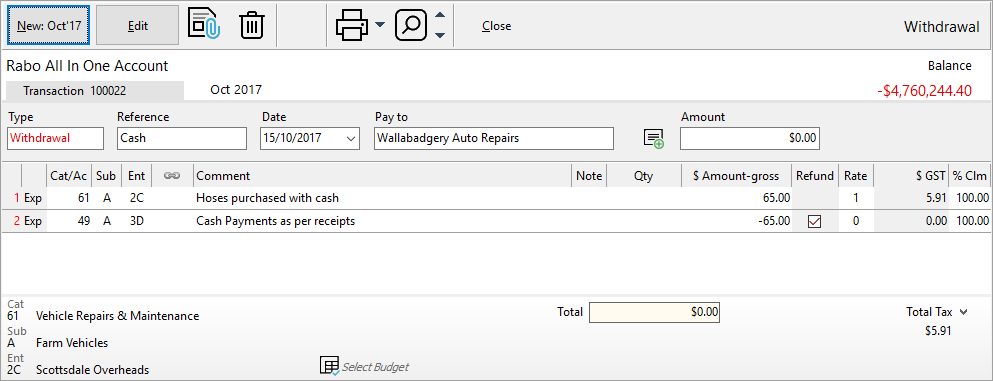

In the following example a business expense had been paid for with cash and it needs to be brought into the books for claiming the GST and income tax calculations. If the cash has been withdrawn from the business previously as personal drawings the cash payment amount will be returned to the personal drawing category/sub-category appropriately.

If the cash was from private income sources and used for the business it may be appropriate to show that as capital introduced.

|

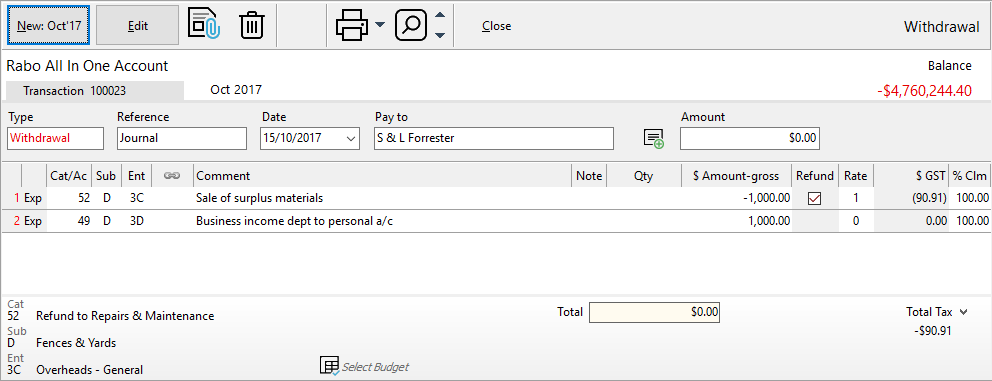

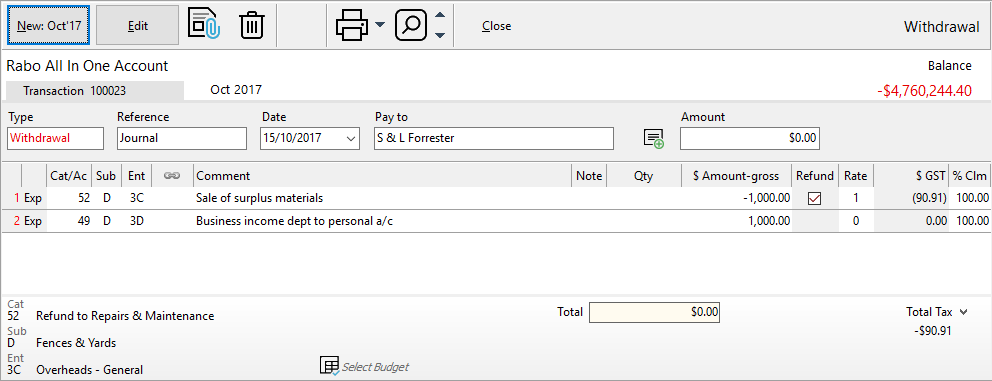

In the following example surplus material which had previously been purchased by the business and had the GST claimed on it as well as the expense for income tax purposes was sold and the proceeds of the sale deposited to a personal account. If the proceeds were received in cash and used for personal drawings the transaction would have been entered in the same way.

|

Please Note: There are rules set by the Australian Taxation Office about how and when GST corrections can be made. Please refer to your accountant or taxation advisor before making an entry such as the one shown below to ensure it is appropriate for your situation.

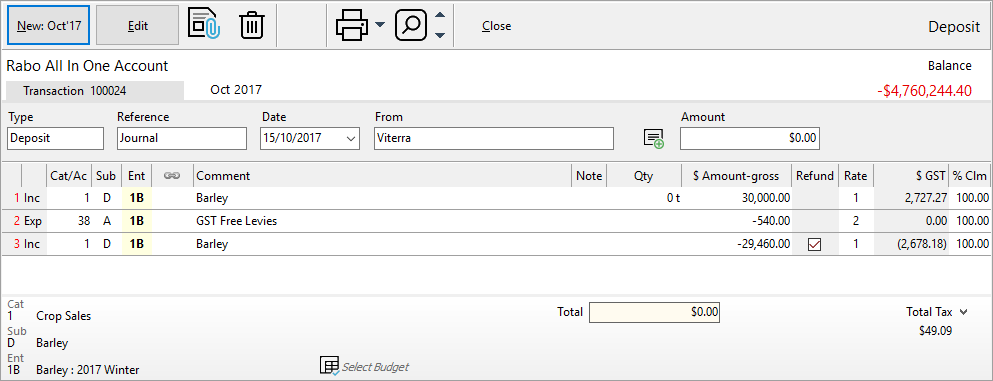

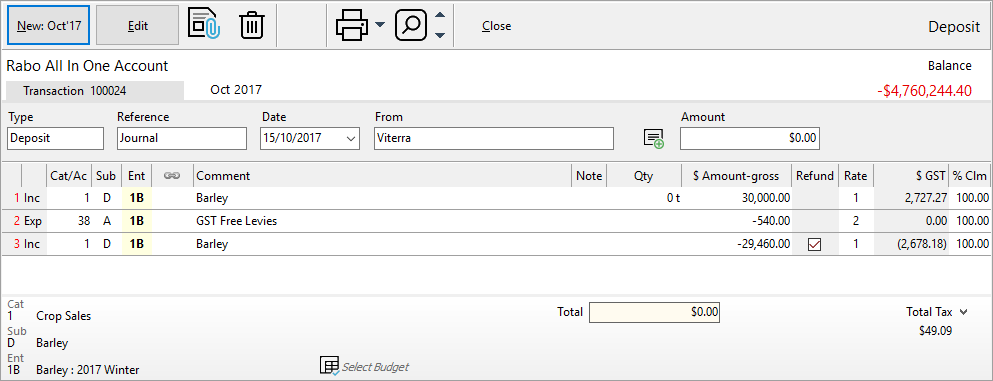

The following example corrects a transaction entered in a previous BAS period where income was received for the sale of grain but the GST free levies weren’t recorded.

The first two dissection lines record the transaction as it should have been and the last dissection line reverses the way it was originally entered. In this example the correct GST amount is $2727.27 but originally only $2678.18 was reported on the BAS.

|

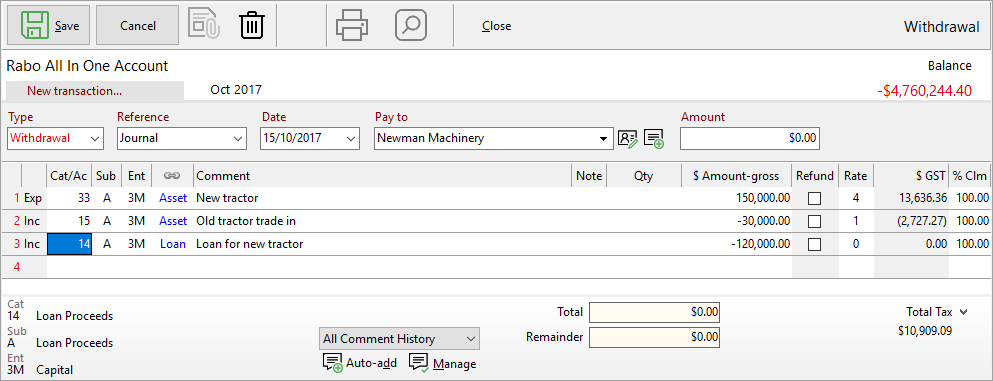

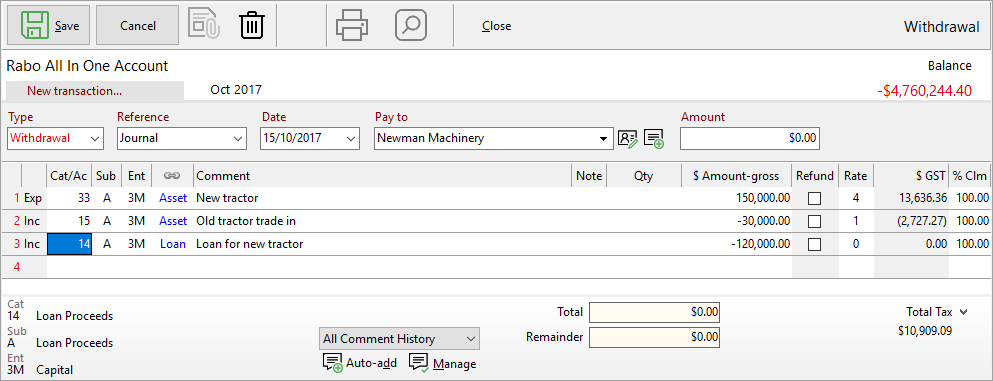

If an asset is purchased, an old one traded in and the balance owing borrowed there may be no money actually going through the bank account at the time of the purchase, but the GST may be able to be claimed in full at the time of the purchase and the purchase needs to be recorded for later income tax calculations and to update the Net Worth report.

The following example shows how this scenario would be entered. Using Enterprises and links to asset and liability accounts is optional. More information on entering asset purchases can be found in the FIN_7005 Enter Asset Purchases Help Note available under Support on the AGDATA website or by contacting Technical support.

|