|

Navigation: Financial > Configuring Financials > Integrating e-PayDay with Phoenix Setting up the Integration in Phoenix |

Scroll Prev Top Next More |

If you haven’t already created an expense category to record the wages, now is the time to create it following the example below. If you have created a category or many categories to handle your wages, you will need to restructure as only one category can be used in this integration. Your categories will need to reflect the example below. If you have set up liability accounts for group tax and/or Super Guarantee Levy, they should be linked to your sub-categories as shown below. The recording of liability accounts is optional. If no links are defined in Category Setup, the integration of transactions to the cashbook will proceed without them. Using The Logisoft Payroll Series, the payroll program records and stores all information relating to individual employees. There is no need to record this in Phoenix. Individual sub-categories or sub-accounts for employees is no longer required. The integration will not allow entries to be allocated to individual employee sub-accounts and sub-categories.

If you have worked with wages categories before, it is our recommendation that you create this new category structure from here on in and leave your old structure as is so you can report on any past wages transactions. This also applies to any liability accounts that have previously been used to track Tax Withheld and Super – we recommend creating new accounts when you commence using payroll. Once your categories (and liability accounts, if applicable) have been sorted, continue the following steps to integrate. Note that the linking shown above is optional. Gross Wages and Tax Withheld will be imported if the category mapping below is setup. The linking is only required if you plan to maintain your employee liability accounts. If you are linking to the liability accounts, you must link to the account and sub-account. If you link to the account only, then the import will not be able to complete the link. Note: Even though it is optional, the linking is the only way that Phoenix can import any information about the Super Guarantee Levy liability.

|

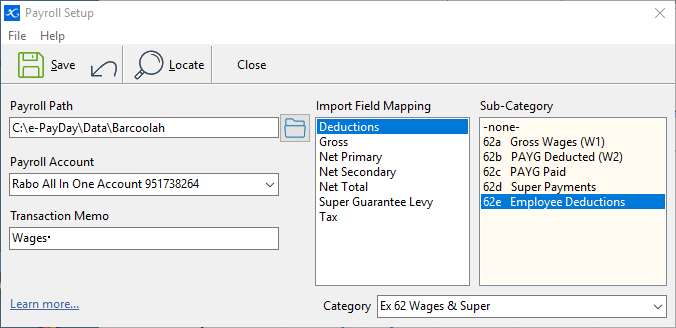

In this step we are going to "tell" Phoenix how to read the Payroll data. 1.Click Payroll on the menu bar and select Third Party Payroll. Select Setup for e-PayDay.

2.At the end of the Payroll Path line, click the blue folder to open the Browse window. 3.You now need to direct Phoenix where to import the payroll information from. The location differs depending on the e-PayDay edition that you are using: 4.Nominate which bank account the payroll will be paid from by clicking on the Payroll Account drop down. 5.*Optional: The Transaction Memo field is a field where you can type in a memo to be attached to each Payroll transaction that is entered into Phoenix. It is a general comment that applies to each transaction that is imported from Payroll into Phoenix. This is not necessary for Payroll Import to function. 6.There are 3 Import Fields that must be mapped for the Payroll import to function correctly. They are Gross, Deductions and Tax. 7.Click Tax from the Import Field Mapping list. 8.Click Deductions from the Import Field Mapping list. 9.*Optional 10.Save your settings by clicking on the 11.Confirm the Save. 12.Now that the Setup is complete, you can import you first Pay run.

|

©2020 AGDATA Holdings Pty Ltd trading as AGDATA Australia