If a transaction was entered in the past but subsequently not cleared at the bank and later needs to be written off, the normal Write Off function can’t be used if the original transaction includes a link to an account which has since been closed.

This situation can arise for a number of reasons but one possibility is that between the time of the original transaction and the decision to write off the uncleared transaction, a migration has been done from Aged Trading Customers and Suppliers to Open Item Customers and Suppliers. The migration process closes the old aged trading Customers and Suppliers and opens new Open Item ones and transfers any existing balances.

The Write Off process creates a complete reversal of the original transaction so where the transaction included a link the reversal also applies to the linked account. Using a Supplier Payment as an example the original transaction would have been an expense transaction in the bank account and an income transaction (payment) in the sub-account for the supplier being paid. The Write Off puts an income transaction into the bank account and an expense transaction into the supplier sub-account. If the linked account (in this example the supplier sub-account) has been closed the entry can’t be created for that side of the transaction so the Write off can’t proceed.

When a transaction is entered into an account tracked for GST any GST portion is recorded in the GST Control account and is used in the calculation of the amount of GST To Pay or Refund for the period in which the transaction was recorded. If that transaction isn’t cleared in the account in which it was entered it needs to not only be removed from the account in which it was entered and any linked account, but it also needs to have the GST corrected. Write Off will do this as well.

When the Write Off function can’t be used because the linked account has been closed it will be necessary to manually create the reversal transaction.

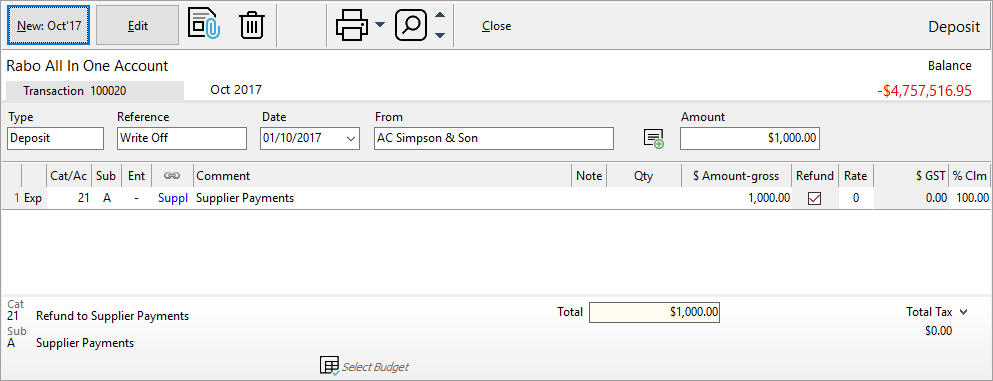

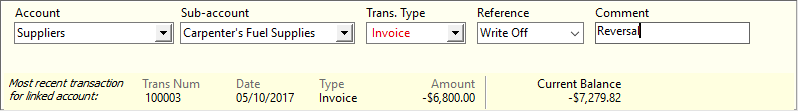

The example below is a manual reversal of a Supplier Payment which had previously been entered into the bank account and linked to an Aged Trading Supplier, but not cleared and subsequently the Customer and Supplier accounts migrated to Open Item.

In the Link field the transaction is not linked to Past Supplier which is now closed, but to the new Open Item Supplier.

On an accrual basis for GST reversing the original transaction has no impact on the GST as that was accounted for when the invoice was entered.

On a cash basis for GST reversing the original transaction will also correct the amount of GST collected or paid because on a cash basis GST is accounted for when a payment is made or received.

In the example above, depending on whether the balance of the supplier sub-account is a debit because the amount is still to be paid or a credit because the original payment and a subsequent one has now meant a credit balance the reversal entry will need to be applied to the Opening balance transaction for the supplier.