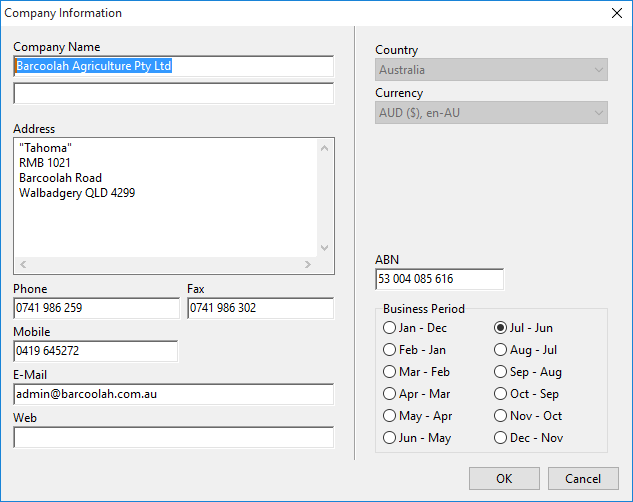

Select this entry window in the Setup menu, and complete the text boxes with your company’s identifying details:

The minimum information required is the Company Name under which you normally trade. The details determine the headings that appear in your printed reports.

The Company Name is printed on every Phoenix report including invoices and statements. Phoenix uses the Company Name and License Name in reports.

Other information:

• Address and other details entered here are used on invoices, statements and other Customer and Supplier documentation printed by Phoenix. For an invoice to be valid your company address details must be entered here.

•The relevant Country should be selected. This step is compulsory before enabling GST Tracking. The country selected here determines the GST rates used in Phoenix.

•The Australian Business Number or New Zealand GST Registration Number should be entered. This is printed on all invoices and statements. Phoenix checks the validity of the number and rejects invalid entries.

•Select the 12-month Business Period that should be applied to the accounts. Select one period from the list using the click-on buttons provided. With Phoenix, you may alter the Business Period at any time

Note also that the Business Period you choose does not prevent you from obtaining reports on other periods of time. For example, if your chosen financial year is July-June, you may still produce reports for any other 12-month period - or for a longer period if desired - after the earliest month for which financial data has been entered.