The balance of the GST Control account at any time shows the GST to pay (negative balance) or GST refund (positive balance) owing for all transactions entered. The GST Control account is therefore shown in the Net Worth report as either a current liability or a current asset.

When a GST payment is made, or a GST refund received, it is essential that the amount be included in the GST Control account to maintain the correct balance, as outlined above. This is best done by linking the transaction that records the cheque payment or refund deposit to the GST Control account. To do this automatically, create a GST Refund and GST Payment category and link them to the GST Control account.

Once this is done, you enter a GST payment or refund transaction in the appropriate account, usually a bank account, and allocate the amount to either the GST Refunds category or the GST Payments category. Phoenix then automatically links the amount as a transaction in the GST Control account. The GST Control account then maintains the true balance owing or payable for the transactions entered to date. The linked payment or refund transaction in the GST Control account should always be included (ticked) when preparing the next GST Return report. Both GST Refund and GST Payments will only affect the Total Payments and Closing Balance (Not the GST to Pay/GST Refund area).

If you prefer, you could have just one category, an expense category called “GST Payments” or “GST Remittances”, linked to GST Control. When you send money to the relevant authority, it is allocated as normal to this category. When you receive a refund, then you allocate it to the same category as a refund.

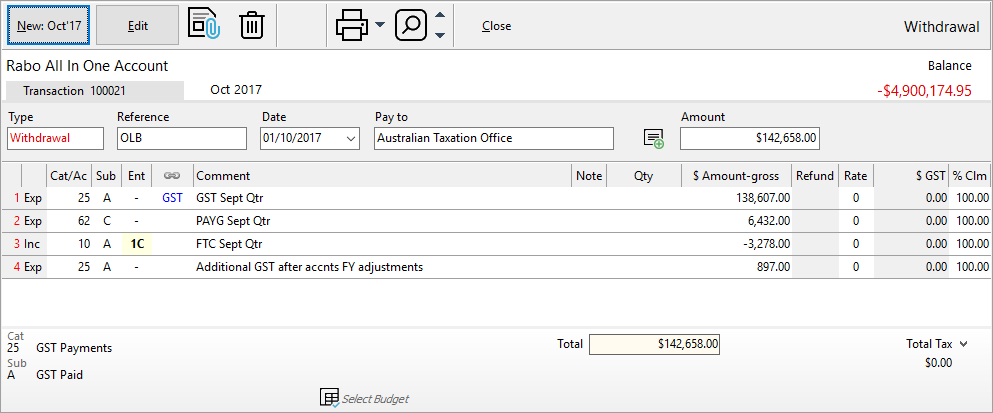

The Business Activity Statement covers GST, PAYG, Fringe Benefit tax etc. The GST Control account in Phoenix only records GST, therefore the payment or refund needs to be split in the transaction. Only the amount that is shown at the bottom of the Phoenix GST Calculation Sheet report from the GST Return (GST to Pay or GST Refund) should be allocated to the GST Control account. Any other amounts need to be allocated to the appropriate expense or income account.