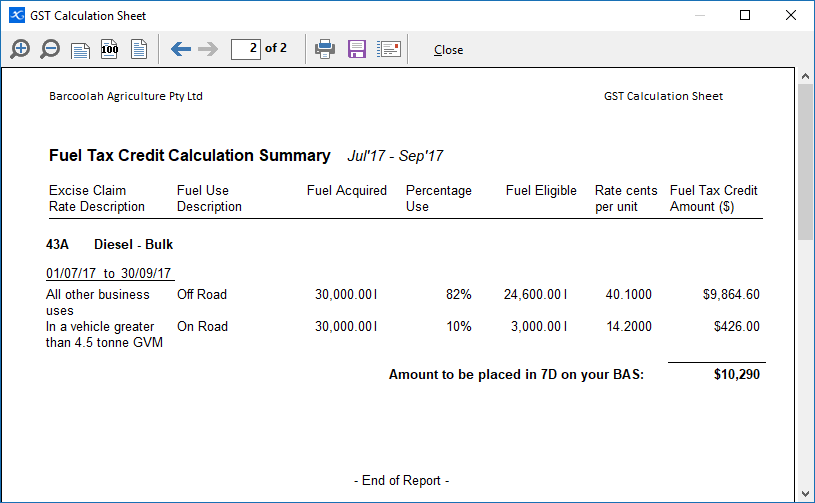

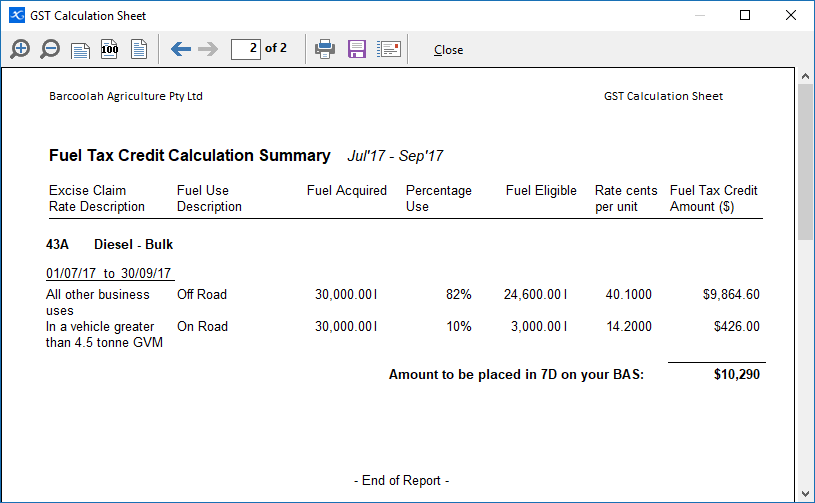

Phoenix reports the Fuel Tax Credit along with the GST in the GST report so that you can fill out cell 7D on your Business Activity Statement. The fuel tax credit report will cover the same period as the GST return.

When producing the GST Report, you will have the option of selecting various components of the report. Like the GST report, there is a calculation sheet, and a transaction audit. There is also a Fuel Tax Credit Setup page. The transaction audit prints a complete list of the transactions that are included in the calculation and the Fuel Tax Credit Setup documents the fuel use proportions used to calculate the credit for the reporting period.

Transactions omitted from the report

If a transaction is omitted from the GST calculations for any reason, then it will be omitted from the Fuel Tax Credit report also. As is the case for the GST, such a transaction will be offered for inclusion in subsequent periods until it is included. There are two methods by which a transaction may be omitted from a GST period.

Phoenix allows a transaction to be entered into a period for which the GST has already been finalised. This may be the case if after a period has been finalised for GST, the bank statement arrives late showing a transaction from within the previous period that you have neglected to enter. Such a transaction can be entered into the already finalised period to which it applied. Since this transaction was not included on the GST and FTC reports for that period, it will automatically be included on the first available subsequent period.

There is also a method by which you can manually select which transactions are included in the GST return. When the GST return is on the screen, there is an Options menu available. In the Options menu, you can elect not to use the default Automatic mode. In automatic mode, all transactions in the period being reported are automatically included in the reports. If you turn off automatic mode, you have the option of including or omitting each transaction in the period independently. This is done by ticking or crossing each transaction in the same manner as the reconciliation.

The Fuel Tax Credit calculation relies on the quantity of fuel being recorded with each transaction. When recording quantities in Phoenix, there is a "units" field to record the units of the quantity. If the units field is left blank, or a unit is used that does not refer to a volume, Phoenix will not be able to convert the quantity purchased to litres. The Fuel Tax Credit is based around a rate per litre, so it is essential that Phoenix is able to convert the acquisition to litres. If any transactions record units other that a volume or are left blank, the calculation summary report will announce this. In this event, the transaction audit report should be inspected to see which transactions are so effected.

|