At the end of a GST period you will need to produce a GST report from the GST return screen in order to complete your BAS. It is recommended that you finalise your GST return at the end of the period, If you do this then you will be prompted to print the GST Report during the finalising process.

To finalise your GST Return and print a GST Report:

1.Click the  button on the Toolbar or from Tasks on the menu to display the GST Return screen.

button on the Toolbar or from Tasks on the menu to display the GST Return screen.

2.Click the  button.

button.

3.Phoenix will automatically check to make sure that all accounts in the Set of Books are up to date with the GST Return period. If it finds some that are behind then Phoenix will prompt you to do something about it. See also: Validate Accounts before Reconciling. You can choose to address these accounts at that time or choose to ignore the warnings and continue to finalise the GST return anyway.

4.Phoenix will then perform a Check Balances to make sure there are no data integrity issues.

5.You will then be prompted to print the GST Report

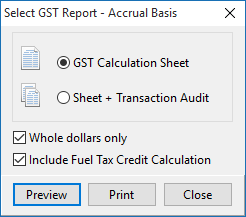

6.Make your selections:

GST Calculation Sheet: Produces a report showing the Summary GST information for each of the "G" codes that you can use to transcribe onto your BAS return.

Sheet + Transaction Audit: Produces a report showing the Summary GST information for each of the "G" codes that you can use to transcribe onto your BAS return as well as detailed breakdown of each transaction that has contributed to each of the respective "G" codes.

Whole dollars only: Omits cents from being shown in the report.

Include Fuel Tax Credit Calculation: Phoenix reports the Fuel Tax Credit along with the GST in the GST report so that you can fill out cell 7D on your Business Activity Statement. The fuel tax credit report will cover the same period as the GST return.

If Sheet + Transaction Audit is selected as well both the GST and FTC Calculation Sheets are produced along with the GST and Fuel Tax Credit transaction audits which provides a complete list of the transactions that are included in the calculations, and the Fuel Tax Credit Setup which documents the fuel use proportions used to calculate the credit for this period.

7.Either Print or Preview your report. If you preview the report you can then print it from the preview screen.

Should you wish to view your GST Report before finalising your GST Return you can use the  button to print and preview a report for the GST period currently selected.

button to print and preview a report for the GST period currently selected.

Warning: It is NOT recommended that you submit a BAS based on a report from a period that has not been finalised. If any transactions are added for the GST period after submitting your BAS and before finalising the GST Return, then this could potentially alter the GST amounts.

See also: