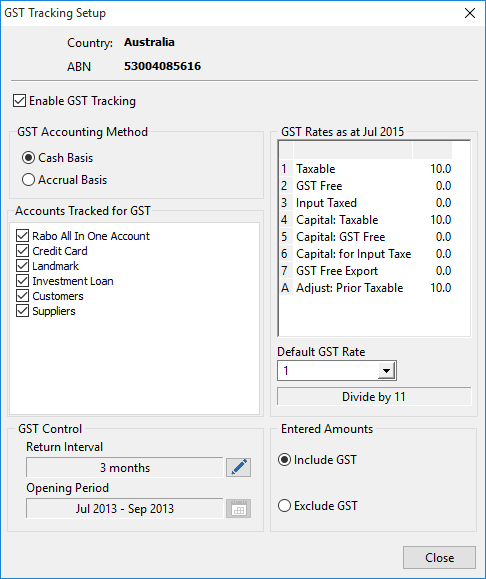

Enabling GST Tracking

The GST Setup screen is accessed from the Setup from the menu bar. If the GST option is not visible in the Setup menu, then you must first set the Country in Company Information (under the Setup menu) to one that requires GST.

Country & ABN

The Country field is determined initially by the regional settings defined in the Windows control panel. This determines a number of terminologies and default rates issues throughout the GST implementation. For instance, the registration number is called GST Registration Number in New Zealand, and ABN (Australian Business Number) in Australia. Phoenix tests the format and validity of these registration numbers according to the rules determined by the respective government authorities.

To change the country, you should edit the country in Setup - Company Information . Once GST Tracking has been enabled for a particular country, then changing the country is disabled.

Enter your ABN in the field provided. Phoenix checks the validity of the entered number.

Enable GST Tracking

Ticking this check box causes Phoenix to setup the GST rates according to the country that you selected in Setup / Company Information. Phoenix also creates a special Reconciled Account that is by default named “GST Control”. (If you go into Account Setup you will see this account listed).

GST Accounting Method

Select the GST Accounting Method that you will use in this Set of Books. Confirm with your accountant which method you should select. See also: Terms & Concepts

Accounts to be Tracked

These are the Reconciled and Customer and Supplier Accounts for which GST is to be tracked.

GST Rates

This is where the GST rates are maintained. Both the description and the Rate percentage of any of the predefined rates can be changed. After a rate percentage has been changed, any new transaction for a tracked account that uses the changed rate will apply the new rate.

The default rates displayed here are appropriate for the country selected. Phoenix uses the various rates displayed to determine how to prepare for the GST return required for your country. You will not need to make any alterations here unless changes have been made to your countries’ GST implementation since these parameters were set by AGDATA in accordance with ATO BAS instructions. Any changes made here may result in erroneous information being prepared for your regular returns. Changes should never be made in the middle of a GST reporting period.

Default Sub-category GST rate

This allows the selection of a GST Rate for which all sub-categories default to. This will probably always be 1, which is the “Standard” rate. Any sub-categories, for which the default rate is not applicable, will have to be manually changed in Category Setup. See also: GST Rates in Category Setup

Return Interval

This is the period interval for which a GST Return must be generated. It is in fact similar to the Interval field in Account Setup. It can be thought of as the “Reconciling Period” for the GST Control account. Set this field according to your GST return period.

To set or change the Return Interval, click the button to the right of the field. Select from the list of period options available.

Phoenix allows you to change the Return Interval at any time; however, your government requirements may not be so flexible. Ensure that the selection made here complies with the legislation in your country, and that you meet the requirements of the selection that you make.

Opening Period

The Opening Period is the first period for which GST tracking is enabled. This should conform to the start of one period for your GST return.

If you are starting Phoenix for the first time at a point of time that does not correspond to the start of a GST period, then your first GST return may need to be put together with one or more shorter periods. For example, an Australian user starting a business and Phoenix in November, using 3 month GST periods where the first return is due for the quarter ending December would need to start with 2 month interval from November. After printing and finalising November and December, change to 3 monthly intervals.

Include / Exclude GST

This applies only to transaction entry and determines how the Dissection amount of a dissection line is entered or shown. If "Includes GST" is checked, the gross dissection amount (including GST) is displayed, otherwise the net dissection amount (excluding GST) is displayed. Making a selection here determines the default state when entering transactions, however it is possible to swap entry modes whilst actually entering any transaction.

Notes

Unticking the Enable GST Tracking checkbox (i.e. disabling GST Tracking) effectively closes the GST Control account if the balance is zero. If the account is closed, no accounts are GST Tracked and the GST Control account will be treated as an ordinary closed reconciled account. If GST tracking is re-enabled at any time, a new GST Control account with the same default name as the old closed one is created. The name can be changed in Account Setup to avoid confusion.

The only reasons for unticking the "Enable GST Tracking" checkbox would be if you cease to be registered for GST, or if a successive government repeals the GST system.