To un-apply a payment open Customers (or Suppliers) and the customer (or supplier) sub-account in which a payment needs to be un-applied. Double left click the payment to be un-applied. The example below is for a $10,000.00 customer payment which has been applied automatically and therefore to the oldest unpaid invoice instead of the invoice the payment related to. The invoice and payment are in the finalised GST period.

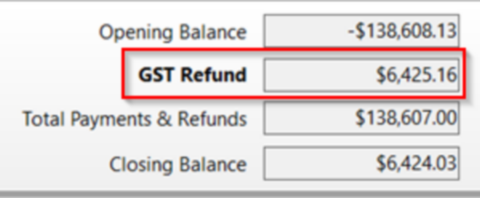

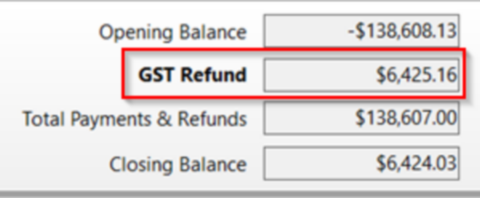

The GST amount for the finalised GST period is GST Refund $7,334.26.

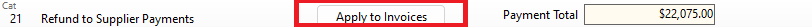

Double left clicking the highlighted $10,000.00 applied payment. In the next window, select Apply to Invoices.

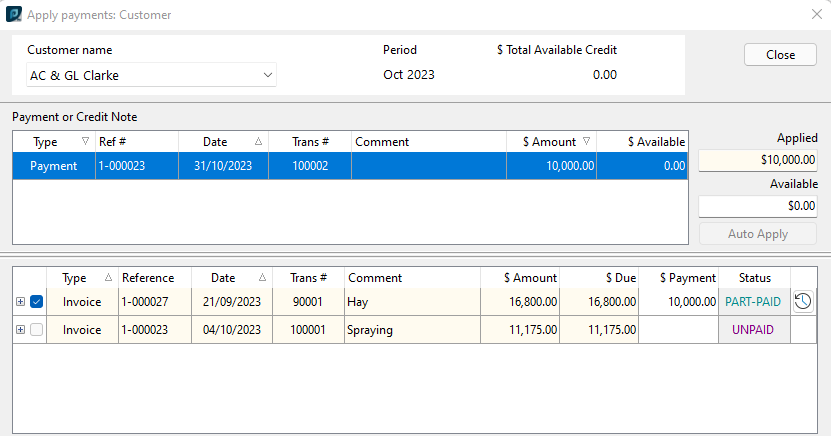

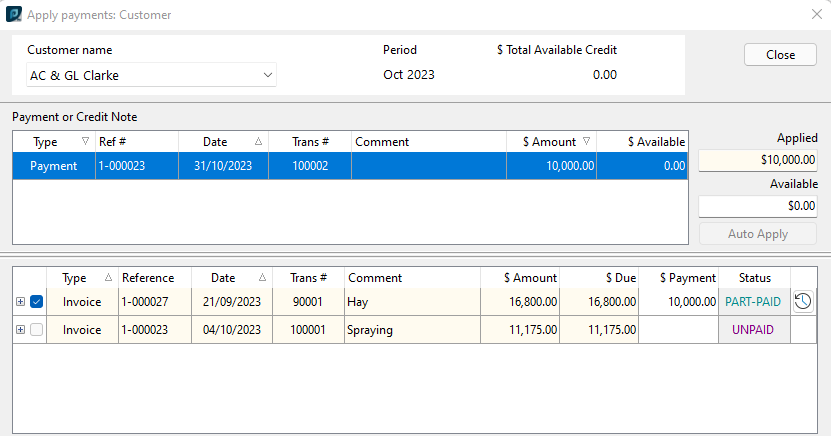

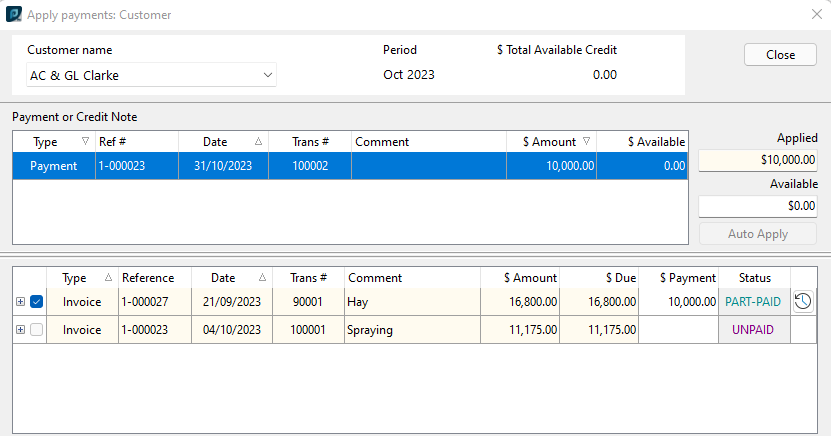

This opens the Apply payments: Customer (or Suppliers) window.

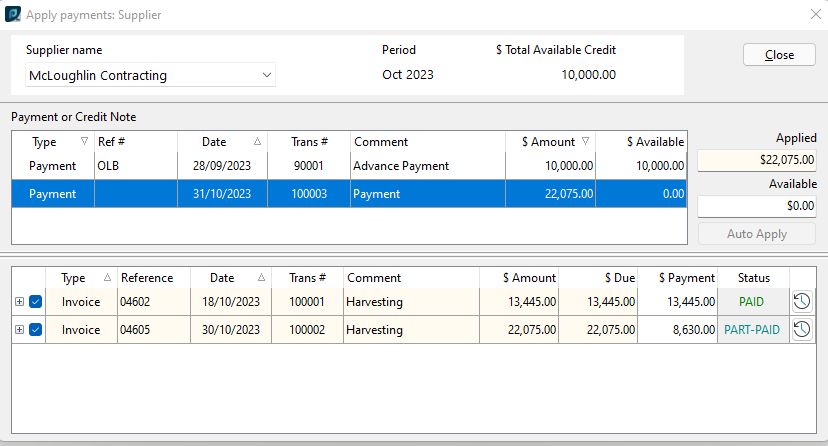

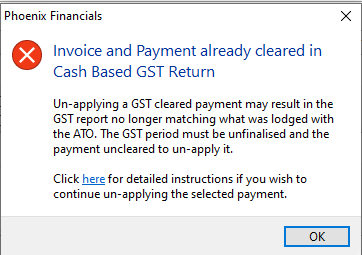

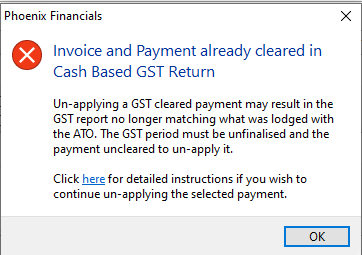

To un-apply the payment from the incorrect invoice click in the checkbox. In this example that is to the left of the $16,800.00 invoice. Because the July – September GST quarter has been finalised a message comes up. Note the warning and follow the instructions to un-finalise GST and unclear the payment(s) to be un-applied.

With the GST un-finalised and the payment(s) un-cleared go back to Customers (or Suppliers) and open the customer (or supplier) and payment to be un-applied as before. Now in the Apply Payments: Customer (or Supplier) window the invoice to which the payment was applied to can be unticked and it applied correctly. Closing the window saves the changes.

In the example used going back and finalising the July – September GST the GST refund amount has now changed. The difference is the GST on $10,000.00 instead of $16,800.00.

|