Note: This section only applies for users who are using the Aged Trading Accounts & Reporting GST on a Cash Basis. See also: Legacy Aged Trading Accounts

By default, when Customer and Supplier accounts (Debtor and Creditor accounts) are created in Phoenix, the accounts are fully tracked for GST. This means that every transaction recorded in the Customer or Supplier accounts creates a corresponding entry in GST control.

Each such transaction automatically generates an entry in the GST Return process, thus reporting GST on accrual basis.

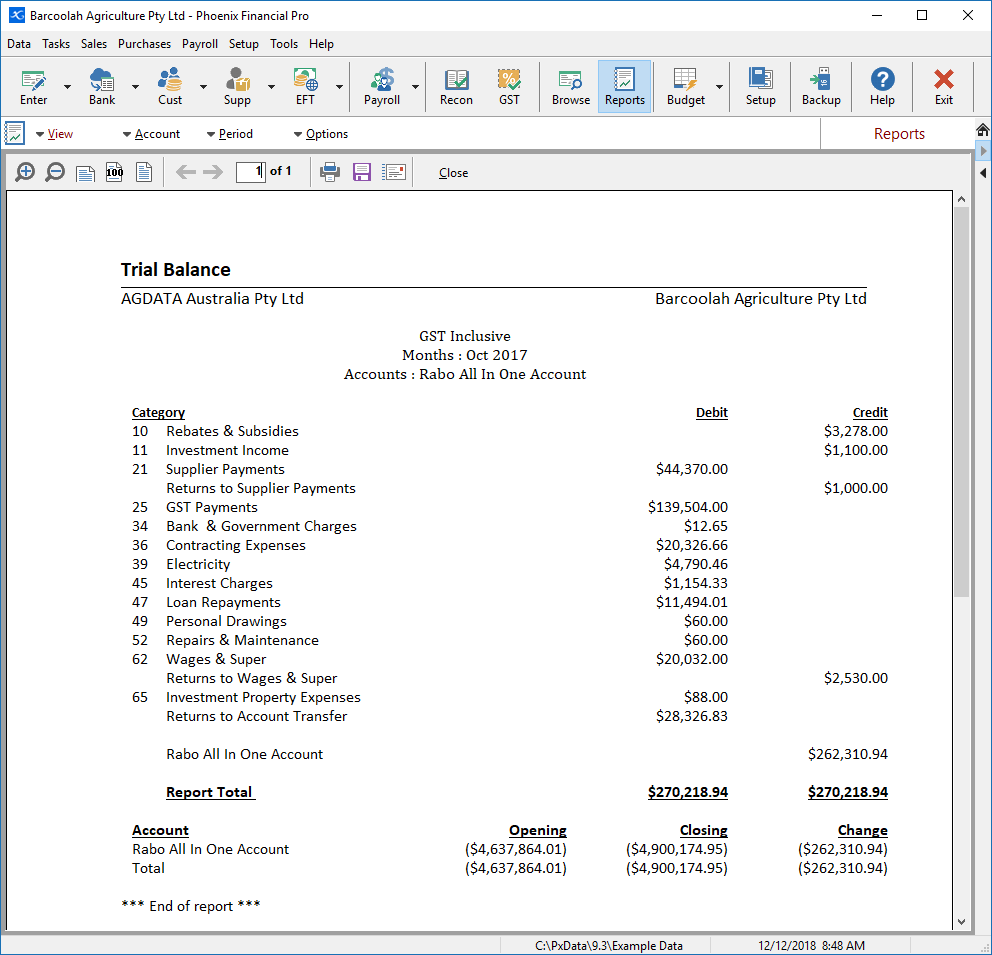

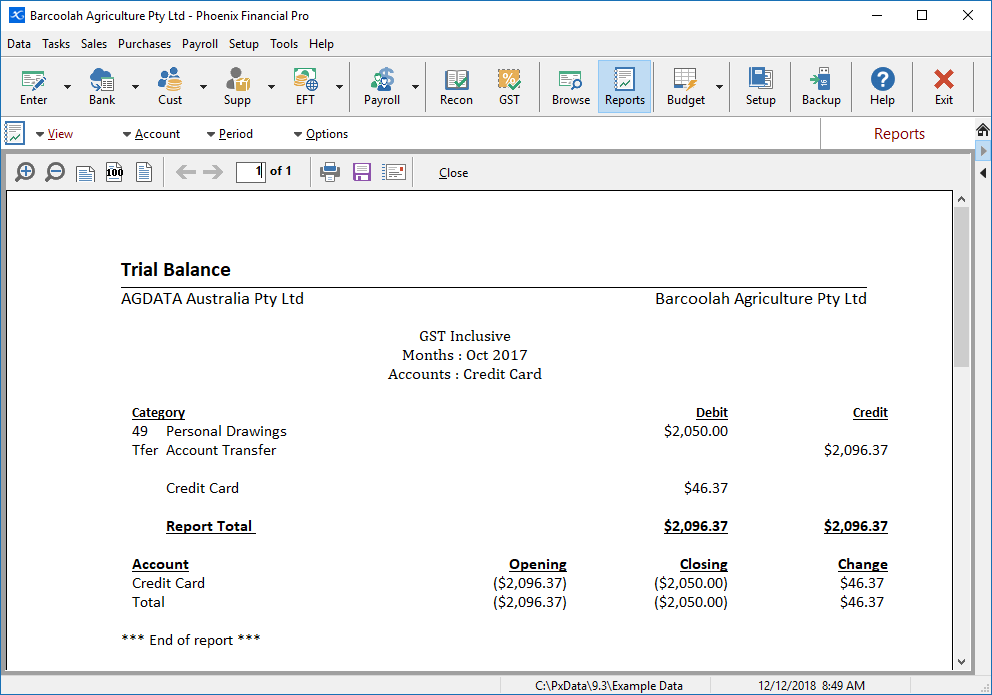

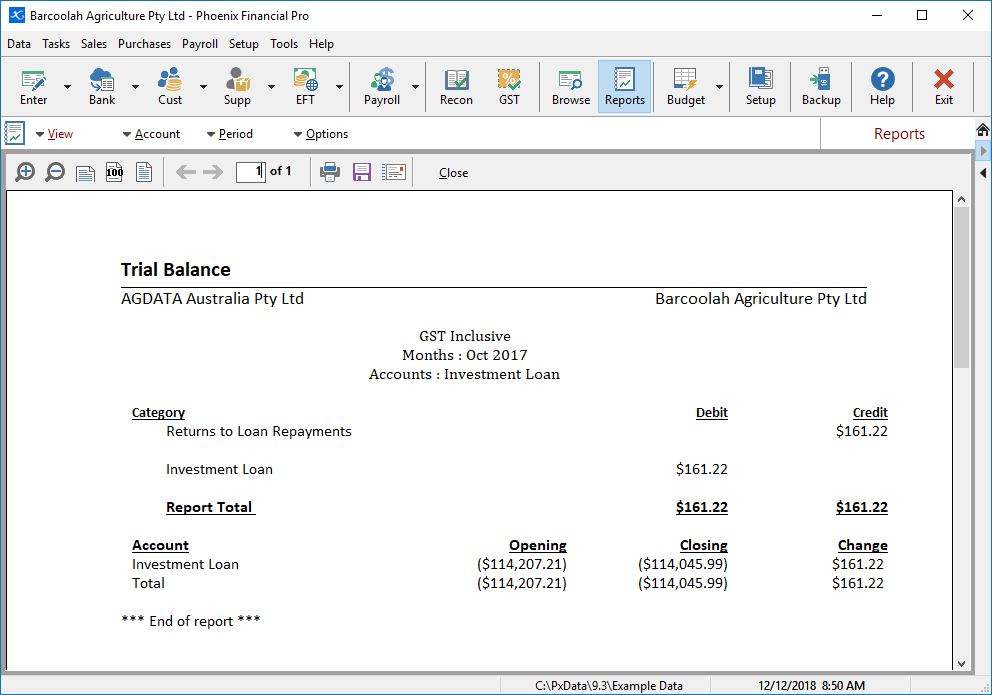

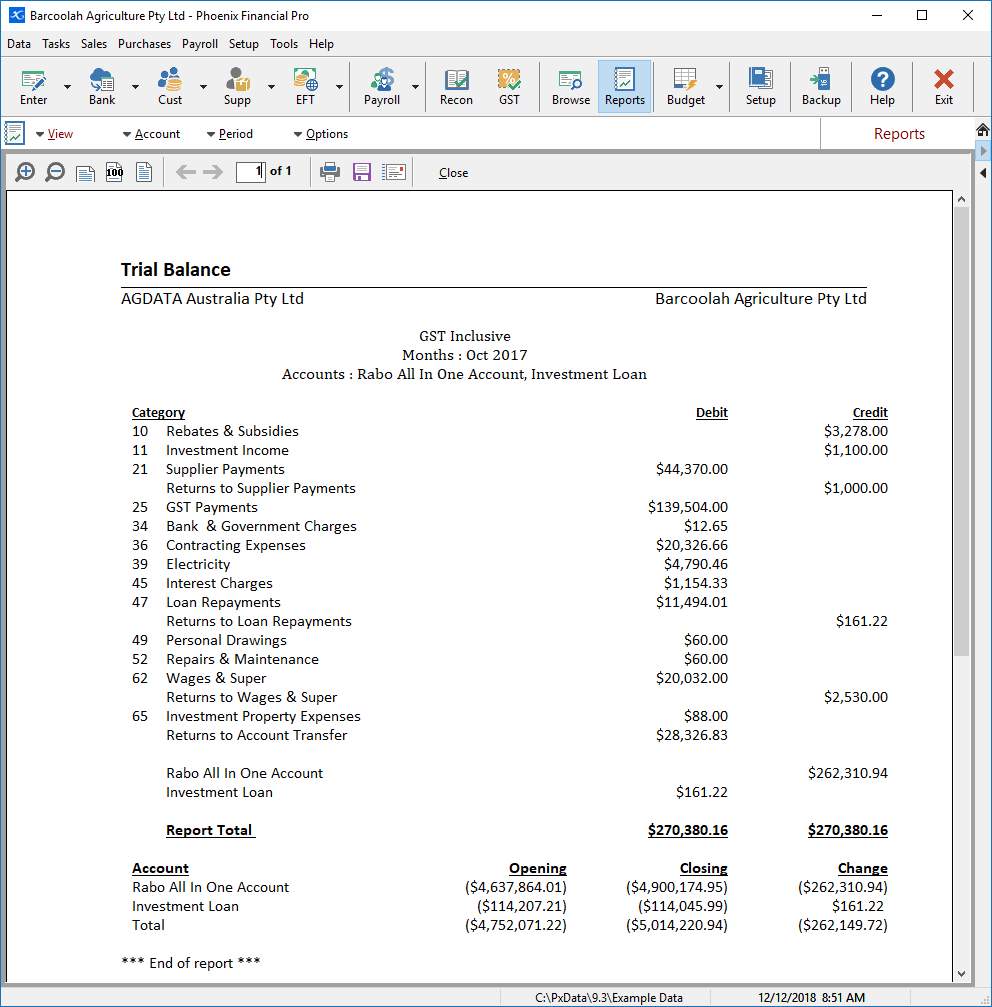

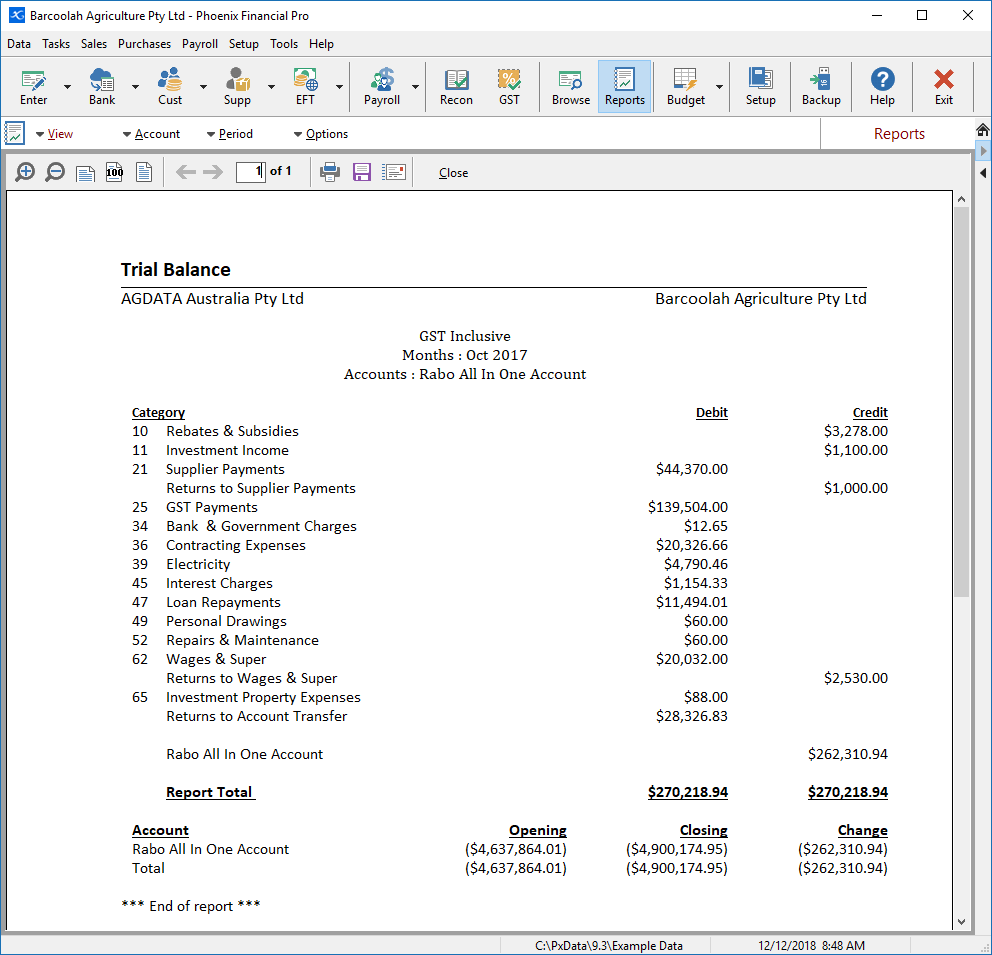

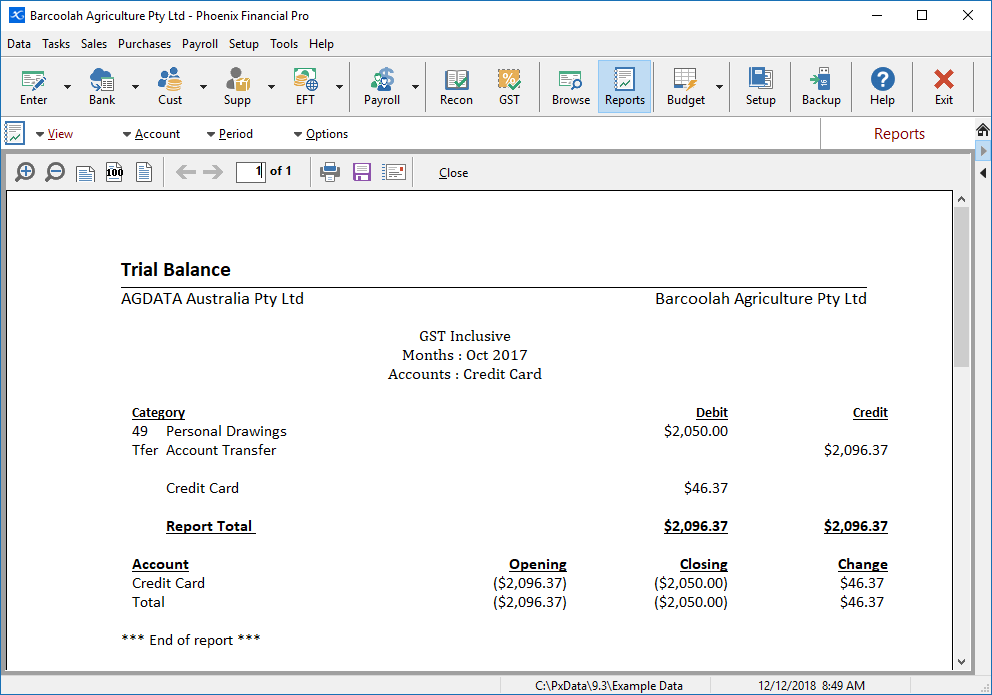

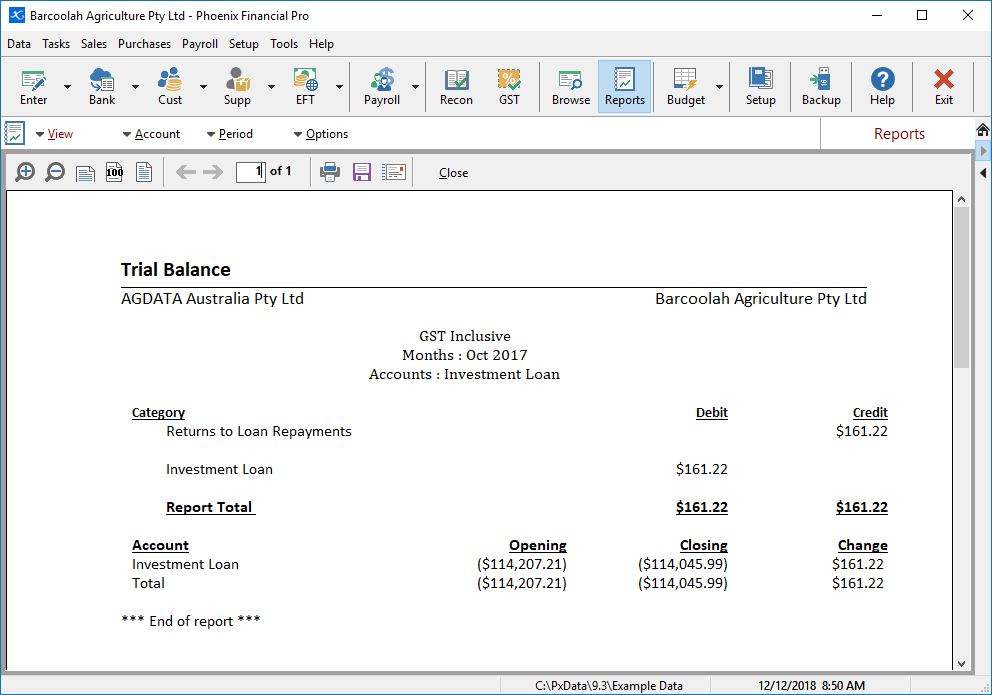

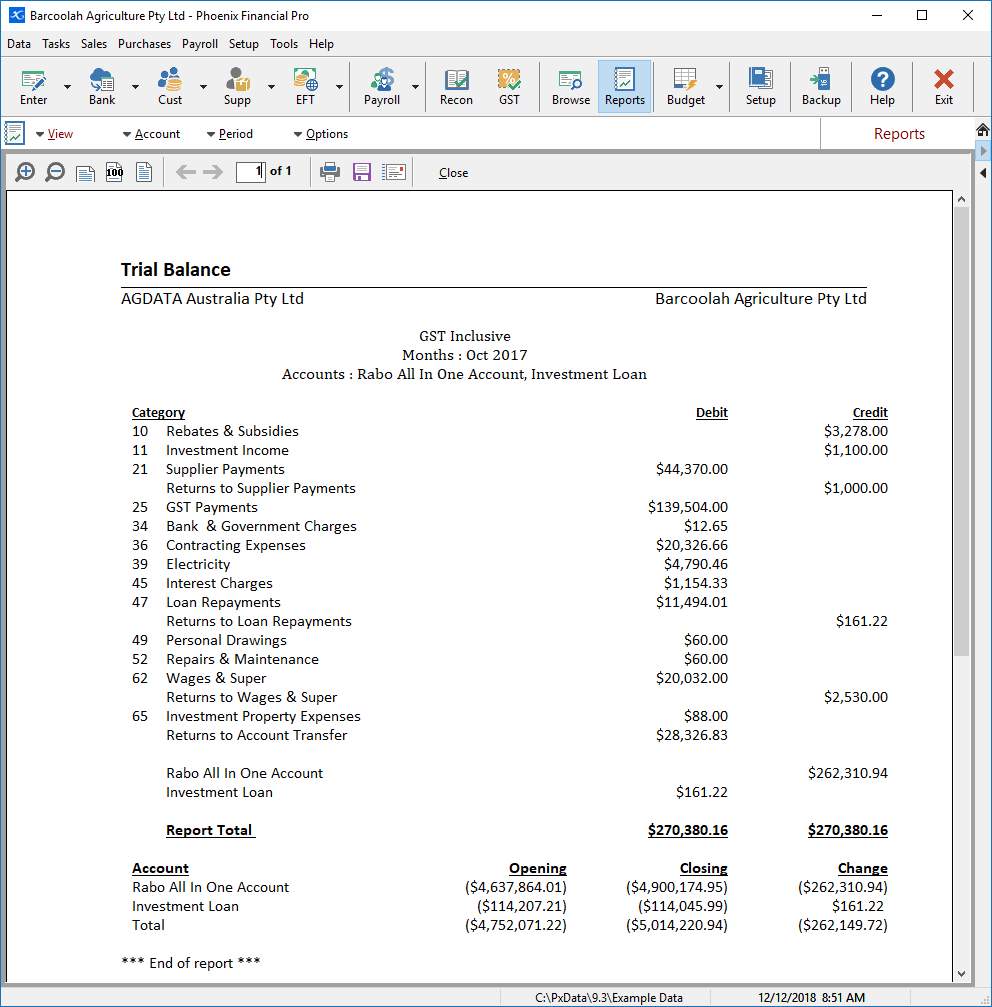

To provide for the situation where a client chooses to record Customer and/or Supplier accounts in the system and produce tax invoices for Customers, but still report GST on Cash basis, Phoenix provides an "Invoice Only" setting for Customer and Supplier accounts. When setup as Invoice Only, Transactions in Customers and Suppliers will calculate and display GST on the screen, and on printed tax invoices, but the transactions are not reported to the GST return. Below is an explanation of how this is shown when reporting a trial balance which includes accounts fully tracked for GST (reconciled accounts) and accounts tracked on the invoice only method.

When the Trial Balance is produced inclusive of GST, there are no problems since all entries report at the full amount, and every entry has a balancing entry.

A transaction for $11 inc in an Invoice Only tracked account will report as $11 in the income or expense category and $11 in the account, the GST Control account is not reported.

A transaction for $11 inc in a fully tracked account will report as $11 in the income or expense category and $11 in the account, the GST Control will report $1 on each side.

|

A transaction for $11 inc in a fully tracked account will report as $10 in the income or expense category, $11 in the account and $1 in the GST Control account.

A transaction for $11 inc on an account tracked for Invoice only will report as $10 in the income or expense category, $11 in the account, but there is no GST control account for the other $1 since this account is not reporting to GST return, so the $1 reports as "Invoice Only GST".

The amount in Invoice Only GST Control Credit is the GST on amounts invoiced to customers in the report period plus the amount of GST paid to suppliers in the report period.

The amount in Invoice Only GST Control Debit is the GST on amounts invoiced by suppliers plus the amount of GST paid by customers in the report period.

|

See also Information on the Trial Balance