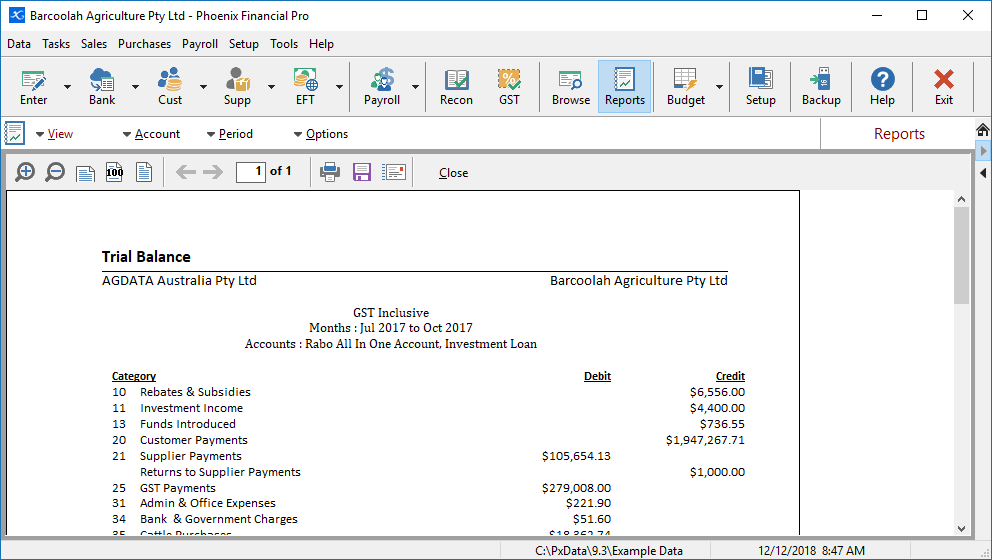

A Trial Balance is a report that is used to confirm that your income and expense entries balance with your account entries. This option allows a choice in Accounts, the Period for the transaction and the Options available for the display of the Trial Balance.

The totals printed at the end of the report show the opening and closing balances for each bank account, together with the change in the balance for the period.

When allocating the GST rate to a transaction in Phoenix, there is an option to specify the percentage of that transaction that is claimable. When calculating the GST return Phoenix allocates the non-claimable component of the Transaction to "Private Use". There is an option in the Trial Balance to show the private use component of the transaction separately from the claimable component. When generating the Trial Balance, in the Options window tick the "Show Personal Use" box to implement this feature.

To view more detail of a particular amount on the report move the mouse over the transaction until the mouse pointer changes to a magnifying glass. While the pointer is still a magnifying glass click on the transaction. This produces another report showing what transactions make up the amount on the report.

See Also