To open the Toolbox click Tools on the menu bar and select Toolbox, or click the  button in the Office Screen.

button in the Office Screen.

There are three option available to you:

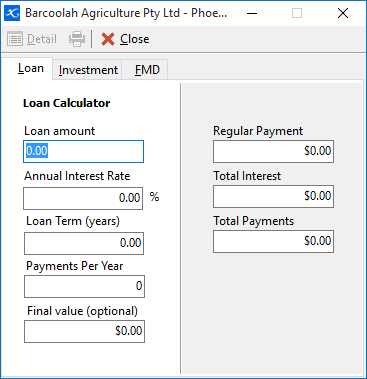

Loan

The Loan tab calculates interest and periodic repayments. Enter the information relevant to your loan on the left hand side of the window. Once you have the Loan Amount, Annual Interest Rate, Loan Term and Payments Per Year entered Phoenix will automatically determine the Regular Repayment, Total Interest on the principal for the period entered and the Total Payments on the right-hand side.

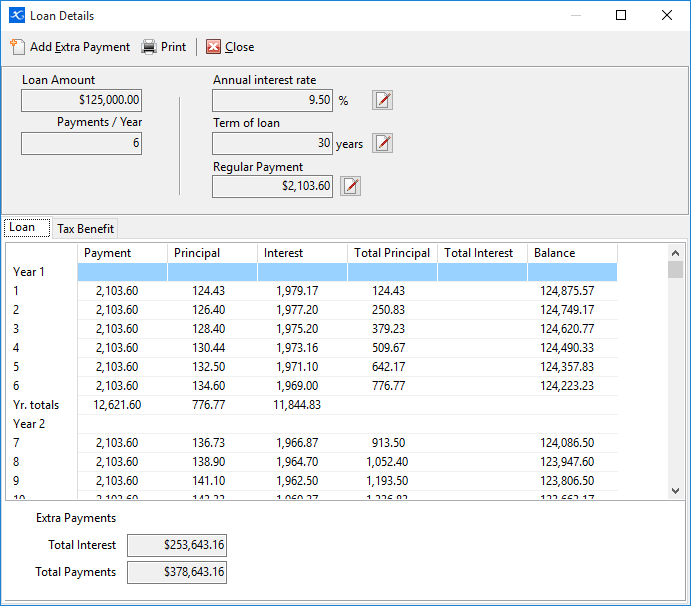

Selecting the Details button displays the following screen:

This screen gives a complete listing of all repayments and the associated reduction in principal and accumulation of interest for your loan.

Additional factors that influence payments can be added here:

•Additional repayments can be factored in by clicking the Add Extra Payment button on the function bar - the schedule automatically updates the principal and interest amounts.

•Tax deduction claims and depreciation, to calculate the net tax advantage derived from the item. To do this, select the Tax Benefit tab at the bottom of the Details screen. You will be prompted to enter in the depreciation rate for the item and your current tax rate. The cash flow required to meet the repayments are re-calculated, having considered the items tax benefit to your business.

Investment

The Investment tab calculates returns on investment. Enter the Deposit amount, the Interest Rate and the Term on the left hand side and Phoenix will automatically display your investment return on the right hand side.

FMD

The FMD tab calculates returns on Farm Management Deposits. Enter the Deposit amount, the Interest Rate, and the Start and End dates of the facility on the left hand side and Phoenix will automatically display your return and Due Date on the right hand side.